What This Means For Foreign Investors

Understanding a countrys social landscape can help organizations make decisions on where to conduct business, especially those that prioritize ESG efforts.

And, while organizations who invest in high risk locations arent directly involved in any human rights violations, being associated with a high risk city could impact a corporations reputation, or cause financial damage down the line.

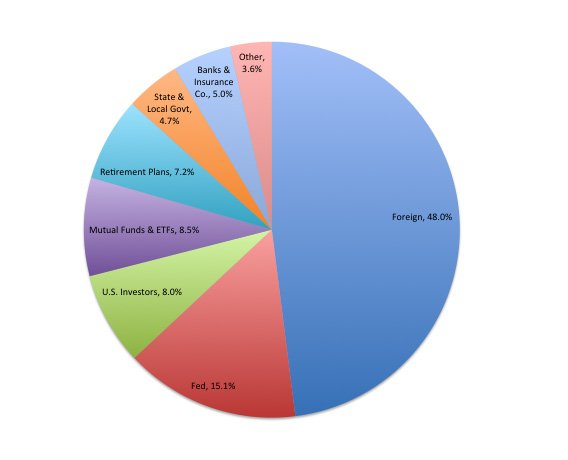

Pie Chart Of Who Owns The Us Debtmarch 23 2007 : 51 Pm Subscribe

Brandon Blatcher2 users marked this as a favoritedelmoi8:57 PMAfroblanco9:05 PMEekacat9:05 PMteece9:06 PMThere’s a Social Security trust fund? Wow! Tell me more about this delmoi ’cause I’m curious about itWikipedia articledelmoi9:11 PMhackly_fracture9:12 PMthen the Chinese have a pretty handy bargaining chip with the US gov’tYawn.frogan9:17 PMEekacat9:20 PMNewshourBlazecock Pileon9:24 PMTo do what?newtotalnewnewteece9:27 PMEekacat9:31 PMhank_149:46 PMthe trust funds are mainly a set of government IOUs payable to itself in the future, a “robbing Peter to pay Paul” arrangementcan So far, we’re not in catastrophe modeKwantsar9:50 PMinconsequentialist9:53 PMComptroller of the GAO is worriedPastabagel9:54 PMthisPastabagel9:56 PMhard-earned and very real claims Kwantsar9:56 PMsmackfu9:57 PMDuring the first Gulf War, a Wall Street Journal reporter asked an anonymous Kuwaiti leader why the Kuwaitis were not staying to fight for their homeland. His response?’That is what we have our American slaves for.'”posted by Pastabagel at 12:54 AM on March 24davy10:22 PMwe owe over TWO POINT TWO FOUR TRILLION dollars to foreign interests. Skeptical Optimist?ZachsMind10:53 PMAnd to clarify my earlier snark, I mean to say the the “Robbing Peter to Pay Paul” argument isn’t one you typically hear from American Liberals, who see the trust fund principally as hard-earned and very real claims principally owned by America’s seniors10:56 PMdw

Us Federal Debt Since 1900

Chart D.13f: Federal Debt since 1900

Federal debt began the 20th century at less than 10 percent of GDP. It jerked above 30 percent as a result of World War I and then declined in the 1920s to 16.3 percent by 1929. Federal debt started to increase after the Crash of 1929, and rose above40 percent in the depths of the Great Depression.

Federal debt exploded during World War II to over 120 percent of GDP, and then began a decline thatbottomed out at 32 percent of GDP in 1974. Federal debt almost doubled in the 1980s, reaching 60 percent of GDP in 1990 andpeaking at 66 percent of GDP in 1996, before declining to 56 percent in 2001. Federal debt started increasing againin the 2000s, reaching 70 percent of GDP in 2008. Then it exploded in the aftermath of the Crash of 2008, reaching 102 percentof GDP in 2011.

Federal debt has breached 100 percent of GDP twice since 1900: during World War IIand in the aftermath of the Crash of 2008.

Also Check: The Profit Key Lime Pie Full Episode

Not Raising Or Suspending The Debt Ceiling

The U.S. could default on its debt if Congress doesn’t raise the debt ceiling once its reached. Congress also has the power to suspend the debt limit, as it did in 2019 with the Bipartisan Budget Act.

When the debt ceiling is reached, the Treasury Department takes various emergency financial measures to help pay the nations bills, buying some time for Congress to make a decision on the debt ceiling. However, those measures can only last so long.

In a statement on Oct. 6, 2021, Treasury Secretary Janet Yellen stressed the urgency of raising or suspending the debt ceiling as a way to prevent default.

Treasury is on the cusp of exhausting its extraordinary measures if Congress has not acted to raise or suspend the debt limit, Yellen said. After that point, we expect Treasury would be left with very limited cash that would be depleted quickly.

When a decision on raising or suspending the debt ceiling is delayed, businesses and consumers often lose confidence in the nation, which could lead to higher interest rates, uncertainty in the financial markets, and a downgrade of the U.S. credit rating.

The Congressional Fiscal Budgeting Process

There are several steps that go into creating a budget. First, in March, departments and agencies submit proposals for their own programs and services that will later be considered as the president builds his own budget. The president passes this on to Congress who look at the budget independently and make adjustments and recommendations. This then goes to the Conference Committee. The House and the Senate then divide the discretionary budget to subcommittees who draft appropriation bills for agencies. Both the House and the Senate vote on their bills, and the separate versions are combined into one that is later voted on and sent to the president. The president needs to sign the federal budget by the end of September for the fiscal year to have a determined budget.

Congress created the national budget process and is largely responsible for its execution. First, the presidential budget for the following fiscal year is submitted to Congress on or before the first Monday of February. Congress typically responds with spending appropriation bills sent to the president by the end of June.

The president has 10 days to reply, and the final budget must be approved by the end of September. In February of this year, Congress ignored the president’s budget and approved a two-year discretionary spending bill. Appropriation bills that outline spending by department will be released next year

Recommended Reading: Patti Labelle Pie Crust Recipe

Americans Own 70% Of Us Debt But China Japan Loom Large

- Email icon

- Resize icon

Who owns the huge and growing U.S. national debt? By and large, Americans.

Some 70% of the national debt is owned by domestic government, institutions investors and the Federal Reserve. A shade under 30% is owned by foreign entities, according to the latest information from the U.S. Treasury.

The nations debt climbed to a record $21.21 trillion at the end of June, a 6.9% increase from a year earlier.

American institutions such as private and state pension funds as well as individual investors were the biggest holders. They owned $6.89 trillion in debt and absorbed about four-fifths of the increase over the past year.

Opinion:Why the economys strength wont help Republicans in November

Foreigners, led by the Chinese and Japanese, owned $6.21 trillion. Those two countries have cut their stakes since 2015, but each country still owns more than $1 trillion worth of Treasury bonds and notes.

The Chinese government or Chinese investors likely own even more U.S. debt purchased through entities in other countries such as Hong Kong, Luxembourg or the Cayman Islands, all of which are havens for tax shelters.

Notably, Russia has slashed its Treasury holdings to a mere $15 billion from a peak of $153 billion in mid-2013 amid worsening tensions with the U.S.

So far theres little evidence that other countries will follow suit to strike back at the U.S. amid ongoing trade disputes. Many need or want Treasury bonds and notes as a safe place to park their savings.

Recent Additions To The Public Debt Of The United States

| ~19,428 | ~106.1% |

On July 29, 2016, the BEA released a revision to 20132016 GDP figures. The figures for this table were corrected the next week with changes to figures in those fiscal years.

On July 30, 2015, the BEA released a revision to 20122015 GDP figures. The figures for this table were corrected on that day with changes to FY 2013 and 2014, but not 2015 as FY 2015 is updated within a week with the release of debt totals for July 31, 2015.

On June 25, 2014, the BEA announced a 15-year revision of GDP figures would take place on July 31, 2014. The figures for this table were corrected after that date with changes to FY 2000, 2003, 2008, 2012, 2013 and 2014. The more precise FY 19992014 debt figures are derived from Treasury audit results. The variations in the 1990s and FY 2015 figures are due to double-sourced or relatively preliminary GDP figures respectively. A comprehensive revision GDP revision dated July 31, 2013 was described on the Bureau of Economic Analysis website. In November 2013 the total debt and yearly debt as a percentage of GDP columns of this table were changed to reflect those revised GDP figures.

Read Also: Original Key Lime Pie Company

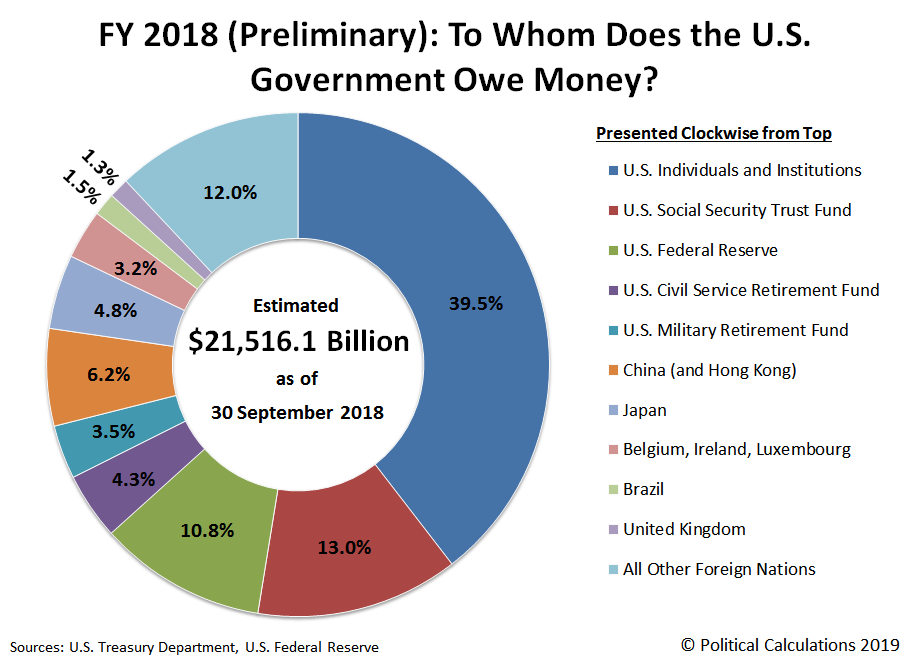

Who Owns $215 Trillion Of The Us National Debt

At this writing, the U.S. national debt has nearly reached $22 trillion, rising by nearly $500 billion since the U.S. governments 2018 fiscal year ended on September 30, 2018.

But to whom does the U.S. government owe all that money? Heres an answer to that question, as if it were asked before the U.S. governments 2019 fiscal year began.

From the end of its 2017 fiscal year to the end of its 2018 fiscal year, the U.S. governments total public debt outstanding increased by $1,271 billion, or $1.3 trillion, to reach a total of $21,516 billion, or $21.5 trillion. Put a little bit differently, the U.S. national debt grew at an average rate of nearly $3.5 billion per day on every day of the governments 2018 fiscal year.

Thats a very large number, but 2018 was only the sixth largest annual increase for the U.S. national debt in terms of nominal U.S. dollars. Larger increases were recorded during President Obamas tenure in office in 2012 , 2010 , 2011 , 2009 , and 2016 .

So its not an accident that the U.S. national debt has risen to $21.5 trillion, where these six years combined account for 37% of the official U.S. national debt. But to whom does the U.S. government owe all that money?

The following chart breaks down who the U.S. governments major creditors were at the end of its 2018 fiscal year, which is based on preliminary data that will be revised in upcoming months.

Heres the chart:

Craig Eyermann

Future Expectations Of The Debt

In its staff report released in 2019, before the COVID-19 pandemic, the International Monetary Fund says the Canadian federal government experienced favorable economic conditions since the 2018 budget that led to sizeable windfall gains: higher than anticipated revenue collections, lower transfers to households, and lower projected interest rates. On the other hand, pressures loom large on the horizon at the provincial level, with annual health care spending growth expected to rise from 3% to 4½% over a 10-20 year timeframe, contributing to rising net debt to GDP ratios by around 2025.

Yves Giroux, the Parliamentary Budget Officer , finds fiscal policy is sustainable over the long term for the federal government, but is not sustainable for seven of ten provincial governments. The deterioration in provincial government finances over the long term is due chiefly to the negative impact of the pandemic, lower oil prices, and rising health care costs from population ageing. When the PBO defines fiscal policy as unsustainable, he means changes in current fiscal policy are necessary to avoid excessive growth in government debt.

Recommended Reading: Entenmann’s Coconut Custard Pie Recipe

Looking Back At 150 Years Of Us Debt

The total U.S. national debt reached an all-time high of $28 trillion* in March 2021, the largest amount ever recorded.

Recent increases to the debt have been fueled by massive fiscal stimulus bills like the CARES Act , the Consolidated Appropriations Act , and most recently, the American Rescue Plan .

To see how Americas debt has gotten to its current point, weve created an interactive timeline using data from the Congressional Budget Office . Its crucial to note that the data set uses U.S. national debt held by the public, which excludes intergovernmental holdings.

*Editors note: This top level figure includes intragovernmental holdings, or the roughly $6 trillion of debt owed within the government to itself.

Spring 201: To Whom Does The Us Government Owe Money

On Friday, 15 May 2015, the U.S. Treasury identified the national origins of the major foreign holders of debt issued by the U.S. government through the end of March 2015, the halfway point of the federal governments fiscal year. With that information, we can now update our chart showing just who has loaned the U.S. government money in the Spring of 2015:

The big news is that debt held by Mainland China has once again edged out the total U.S. government-issued debt holdings of Japan to reclaim its undisputed spot as the biggest foreign owner of the U.S. national debt. That China is the largest foreign holder of that debt was never really in dispute, however, because the figure for Mainland China omits the amount of U.S. debt held by Hong Kong, which has been under Chinese rule since 1997.

Collectively, foreign entities hold about 47 percent of all the U.S. governments Debt Held by the Public, which totaled $13.099 trillion on 30 March 2015.

Domestically, the big story about the U.S. national debt is that it has been essentially frozen at $18.152 trillion since 13 March 2015, which is when the total public debt outstanding of the U.S. government hit its statutory debt ceiling. Since that time, the U.S. Treasury has been playing something of a shell game to hold the U.S. national debt at that level, replacing the holdings of debt held by entities it controls with I.O.U.s as it continues issuing new debt to other holders.

Read Also: Where Was Key Lime Pie Invented

Data Sources And Methodology

The visualization was created using theMonthly Treasury Statement as the data source for federal government spending of the United States. Gross domestic product figures come from theBureau of Economic Analysis . GDP for FY 2021 is based on the economic forecast for the2022 Mid-Session Review, adjusted for theBureau of Economic Analysis revisions. The spending-to-gross domestic product ratio is included to provide you with context for the trillions of dollars that go out from the federal government annually. Throughout this page, we use the gross domestic product for the Fiscal Year, not the Calendar Year, in order to facilitate an appropriate comparison.

USAspending.gov contains spending data from the federal governmentâs response to COVID-19 and is available to view and download onUSAspending.

Civil And Political Risk Index

In addition to the overall ranking, the report provides insight into specific human rights violations, highlighting which cities are most at risk.

Perhaps unsurprisingly, Pyongyang, North Korea places first on the list when it comes to civil and political rights violations. Under the current North Korean regime, some significant civil rights violations include arbitrary arrests and detentions, the holding of political prisoners and detainees, and a lack of judicial independence.

In addition to North Korea, Syria places high on the civil rights risk index as well, with three of the top five cities located in the war-torn country.

You May Like: Campbells Soup Chicken Pot Pie