Frequently Asked Questions About Diversification

What does diversification mean?

Diversification means not investing everything you have in one area. For example, if you put all your money in one stock, or all in technology stocks, and those stocks go down, all of your money could be wiped out. True diversification protects you from loss because, even if one of your investment holdings completely tanks, it wont drag down the rest of your portfolio.

How do I diversify my portfolio?

You can start diversifying by youre going to make. You can diversify by sector , size strategy .Then decide how much of your portfolio you want each investment to beand rebalance at the end of every year.

How many stocks make a diversified portfolio?

Generally speaking, a diversified portfolio contains at least 20 different stocks. However, its hard to keep track of 20 different investments . You may be better off picking less individual stocks and building the rest of your portfolio with mutual funds or index funds. This portfolio is still well diversified, but easier to maintain.

How To Achieve Optimal Asset Allocation

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Consider it the opposite of putting all your eggs in one basket. Allocating your investments among different asset classes is a key strategy to minimize your risk and potentially increase your gains.

Portfolio Asset Allocation By Age Beginners To Retirees

Financially reviewed by Patrick Flood, CFA.

Asset allocation refers to the ratio among different asset types in ones investment portfolio. Here well look at how to set ones portfolio asset allocation by age and risk tolerance, from young beginners to retirees, including calculations and examples.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Also Check: Marcus Lemonis Key Lime Pie

The Help Of A Financial Advisor

Keep in mind that all investors are different. Even if you fall into one of these three broad categories, your situation may differ from others. Working with a financial advisor is one of the best ways for new investors to enter the markets. Returns and market volatility can vary and depends upon the way you have built your portfolio.

Personal Rate Of Return

How to check it: Your personal rate of return reflects your gain or loss for an asset over a given period — including the initial purchase, subsequent buying and selling, dividends, and compounding — and expresses it as an annualized percentage. Use the free Portfolio Manager tool at Morningstar.com to calculate it on all investments devoted to a particular goal. For example, when totting up retirement investing performance, include accounts in your spouse’s name.

Where you should be: Aim to earn 8% a year with a portfolio for a long-term goal, such as retirement. That assumes that the majority of the portfolio is invested in stocks. Stocks are riskier and experience more ups and downs than fixed-income investments, such as bonds, but they return more over long periods. As you get closer to your goal and dial down the risk by adding more fixed-income investments, you might earn closer to 6%.

How to improve: If you put your money in index funds and exchange-traded funds, your returns will be about the same as those of the funds’ underlying indexes — without much effort.

You May Like: Where Was Key Lime Pie Invented

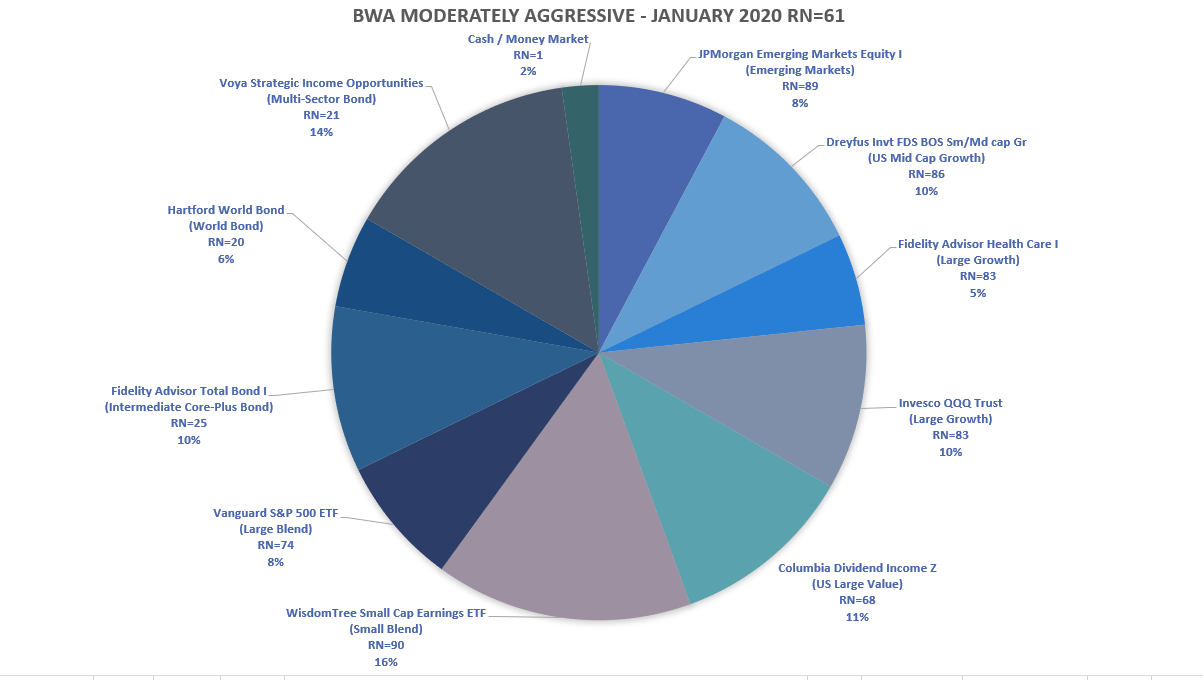

Sample Investor Profiles And Asset Allocations

Illustrative Examples

On the table below circle your answers to the time horizon, investment knowledge and investment objectives questions and your total scores for the risk capacity and risk attitude questions.

Your investor profile is determined by the circle that is in the column furthest to the left in the table.

Review Your Risk Profile

Once you’ve established your investment time horizon, you must now explore how much risk you can realistically handle as an investor. This requires complete honesty. An investment strategy is only as good as the investor’s ability to be disciplined in its execution, so an incorrect evaluation of your risk tolerance can derail your potential for success before you even begin. Here are the different portfolio risk tolerance profiles. Which definition aligns most closely with your emotional convictions? Again, because it’s worth repeating, be honest!

Review your time horizon, then apply the suggested risk profile which best describes you. Once complete, you are set to move forward to the next step.

Read Also: Black Muslim Bean Pie Recipe

Conventional Asset Allocation Model For Stocks And Bonds

The proper asset allocation of stocks and bonds generally follows the conventional model.

The classic recommendation for asset allocation is to subtract your age from 100 to find out how much you should allocate towards stocks. The basic premise is that we become risk averse as we age given we have less of an ability to generate income.

We also dont want to spend our older years working. We are willing to trade lower returns for higher certainty. The following chart demonstrates the conventional asset allocation by age.

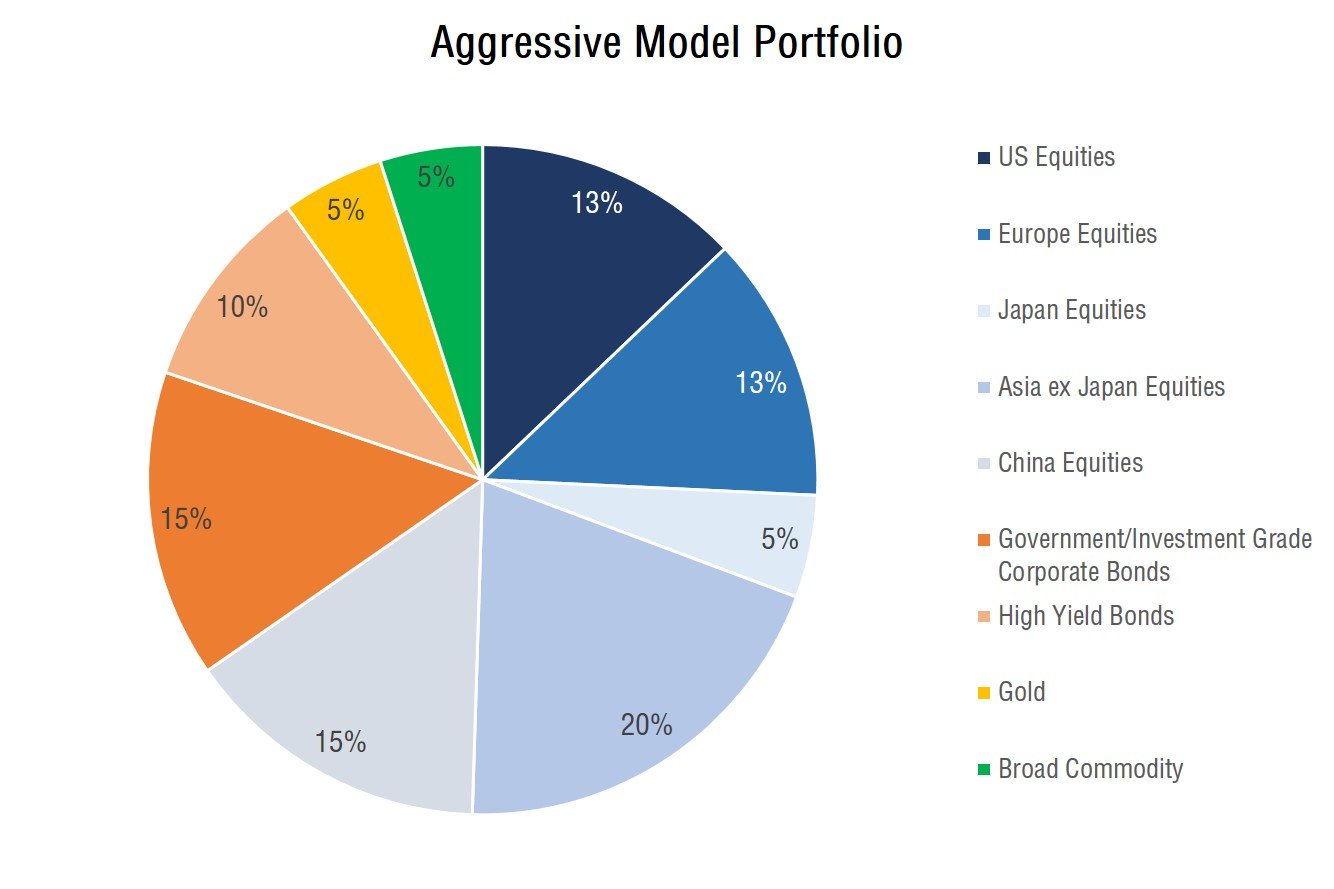

Diversified Portfolio Example #: The Swensen Model

Just for fun I want to show you David Swensens diversified portfolio. David runs Yales fabled endowment, and for more than 20 years he generated an astonishing 16.3% annualized return while most managers cant even beat 8%. That means hes DOUBLED Yales money every four-and-a-half years from 1985 to today, and his portfolio is above.

David is the Michael Jordan of asset allocation and spends all of his time tweaking 1% here and 1% there. You dont need to do that. All you need to do is consider asset allocation and diversification in your own portfolio, and youll be way ahead of anyone trying to pick stocks.

His excellent suggestion for how you can allocate your money:

| ASSET CLASS |

What do you notice about this asset allocation?

No single choice represents an overwhelming part of the portfolio.

As illustrated by the tech bubble burst in 2001 and also the housing bubble burst of 2008, any sector can drop at any time. When it does, you dont want it to drag your entire portfolio down with it. As we know, lower risk generally equals lower reward.

BUT the coolest thing about asset allocation is that you can actually reduce risk while maintaining a solid return. This is why Swensens model is a great diversified portfolio example to base your portfolio on.

Now lets take a look at another handsome investor

Bonus:

Recommended Reading: Bean Pie Recipe Muhammad Speaks

How To Divide Up Your Investment Portfolio To Achieve Killer Returns

This post may contain affiliate links. I only recommend products I trust or personally use. Please read our disclaimer for more info.

It occurred to me after writing the article 3 Ways to Take Control of Your Money and Build a Better Life that I covered all about how you should invest your leftover income, but I dont tell you much about what to investin. I mentioned some good apps to get you started, but I want to make sure that none of you make the same mistakes I made.

So, lets talk about how to divide up your investment portfolio.

The first time I decided to start investing, I took a fistful of dollars and bought stock in a few companies that I knew and used like Apple, Microsoft, and Starbucks. These investments served me fairly well. Most of them grew in the few months that I held them, but I soon realized that Id made a huge mistake.

Id failed to do possibly the most important step when investing your money, diversifying.

Many of my stocks were in the same market sector, so if technology were to take a sudden dive for whatever reason, I wouldve beenup a certain, smelly creek without a paddle.

I want to make sure that you diversify your portfolio, so you can rest easy at night knowing your money is as safe as it can be.

While theres nothing wrong with either one of these companies , youd be a fool to invest only in these two companies.

Why? you may be asking yourself. And my answer is, because your money is not well-diversified.

Historical Return For Bonds

The proper asset allocation must take into consideration bond returns. The average return for long-term U.S. government bonds is between 5% 6%.

Bonds and interest rate performance is inversely correlated. Since July 1, 1981, the 10-year bond yield has essentially been going down thanks to technology, information efficiency, and globalization. As a result, the 10-year bond has performed well during this same time period.

Below is a chart that compares the Vanguard Total Stock Market fund versus the Vanguard Long-Term Investment Grade Bond fund. As you can see, VWESX has actually outperformed VTSMX over a 20-year period. Therefore, dont look down on bonds, despite low rates.

Below is another chart that shows asset class real returns by decade.

Also Check: Damgoode Pies Little Rock Delivery

Candidates For New Life Asset Allocation:

- You plan to live longer than the median age of 79 for men and 82 for women.

- Not that interested in actively managing your own money, but depend on your portfolio to live a comfortable retirement.

- Plan to work until the conventional retirement age of 65, plus or minus 5 years.

- Are a health fanatic who works out regularly and eats in a healthy manner. Sugar is synonymous with poison, while raw is synonymous with utopia.

Morningstar Style Box Diversification

The first way to diversify is to spread your investments based on the Morningstar Style Box, which divides your portfolio into nine categories according to the market capitalization and valuation.

Graphic from Morningstars Portfolio X-Ray Tool

Diversify by market capitalization ensures that you invest in both large companies and small ones. The Value vs. Growth components further diversify as follow:

- Growth Stocks are shares of companies whose earnings are expected to grow at an above-average rate relative to the market. The company is growing earnings and/or revenue faster than its industry or the overall market.

- Value Stocks are shares of companies that tend to trade at a lower price relative to its fundamentals and thus considered undervalued. Common characteristics of such stocks include high dividend yield, low price-to-book ratio, and low price-to-earnings ratio.

Its crucial that you do not mistake growth for a higher return on investment. Based on the Efficient Market Hypothesis, the market already took the higher growth rate into account, and the price already reflects this. A value stock could very well turnaround, become favorable, and outperform a growth stock. Just like before, its not possible to predict if value stocks will outperform growth stocks for any given year. Theres a good article called, Value Versus Growth Monthly Returns that illustrate this concept and explains the image below:

Read Also: The Key Lime Pie Company

Track Your Finances Diligently

Sign up for Personal Capital, the webs #1 free wealth management tool to get a better handle on your finances.

In addition to better money oversight, run your investments through their award-winning Investment Checkup tool. It will show you exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible. Definitely run your numbers to see how youre doing.

Ive been using Personal Capital since 2012. Since then, I have seen my net worth skyrocket thanks to better money management.

Diversification Is Not A One

Once you have a target mix, you need to keep it on track with periodic checkups and rebalancing. If you don’t rebalance, a good run in stocks could leave your portfolio with a risk level that is inconsistent with your goal and strategy.

What if you don’t rebalance? The hypothetical portfolio shows what would have happened if you didnt rebalance a portfolio from 2000 to 2020: The stock allocation would have grown significantly.

How an investment mix can change over time

Past performance is no guarantee of future results.

The resulting increased weight in stocks meant the portfolio had more potential risk at the end of 2020. Why? Because while past performance does not guarantee future results, stocks have historically had larger price swings than bonds or cash. This means that when a portfolio skews toward stocks, it has the potential for bigger ups and downs.2

Rebalancing is not just a volatility-reducing exercise. The goal is to reset your asset mix to bring it back to an appropriate risk level for you. Sometimes that means reducing risk by increasing the portion of a portfolio in more conservative options, but other times it means adding more risk to get back to your target mix.

Don’t Miss: Campbells Soup Chicken Pot Pie

A Factor Not Considered By The Asset Allocation Calculators

Interestingly, none of the four asset allocation calculators considered whether or not we thought that current stock and bond markets were fairly valued, overvalued, or undervalued. Considering this data point would improve the calculators assessment of an investors appetite for risk.

BankRates calculator came closest to considering such a factor by including the investors economic outlook in its model.

On a scale of 1 to 10, is your view of future economic growth and the overall health of the economy. The better your outlook, the more aggressive you can be with your investments.

We concluded that three of the four asset allocation calculators were very useful. We found that the CNN calculator delivered limited value.

Warning: The information and interactive calculators presented are learning tools for your personal use. None of the calculators described above have been checked for accuracy or applicability. These calculators and the articles on this website do not give investment advice. The calculations provided are not financial, legal or tax advice. Investors should seek professional advice from licensed financial, legal, and tax professionals. The circumstances described in this article are hypothetical and are used for illustrative purposes only. These calculators and illustrative examples may use historical performance information, however, past performance does not guarantee nor indicate future investment returns.