Pie Insurance Review 202: Pros Cons Alternatives

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

Pie Insurance is a business insurance startup focused on workers compensation coverage. Founded in 2017, the company now sells workers comp in 36 states plus Washington, D.C. Its policies are underwritten by Sirius America, a global insurer.

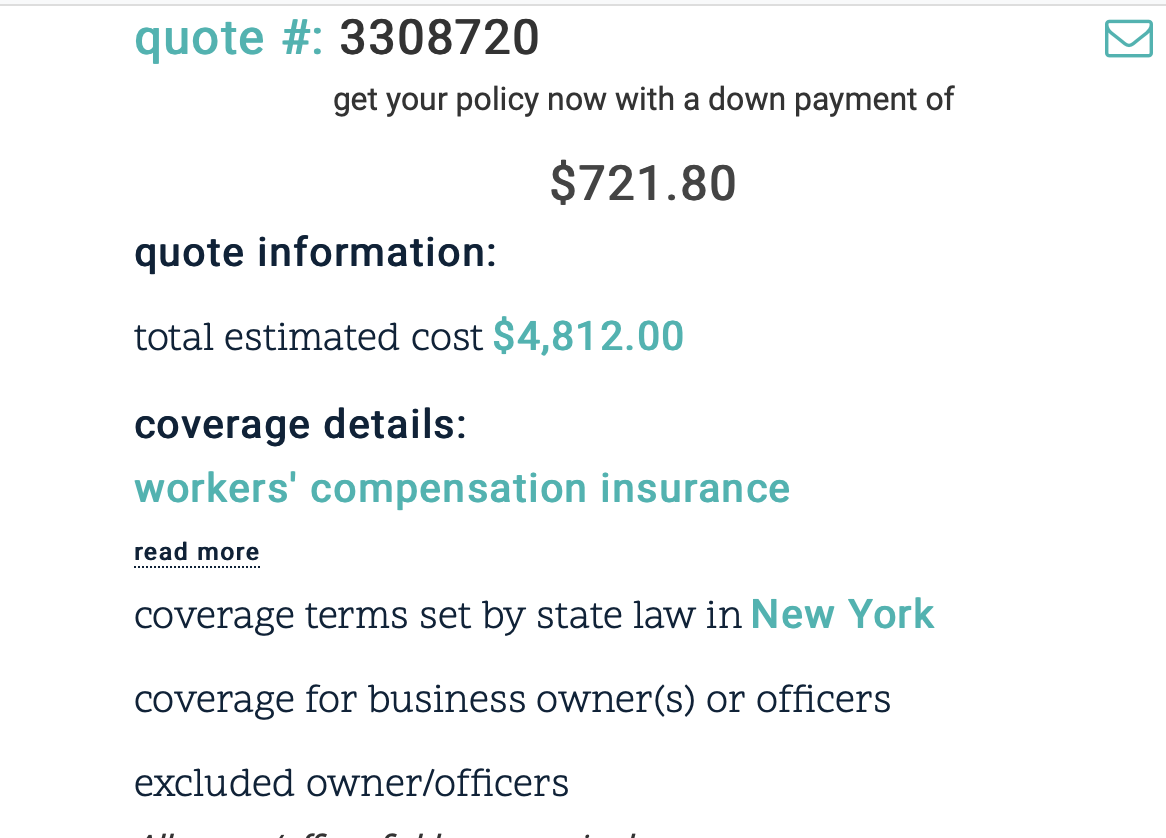

If youre shopping for workers compensation insurance, consider getting a quote from Pie. Pie offers a variety of payment plans and works with CorVel, an experienced insurance administration company, to handle claims. You can answer a few questions online to see an estimated premium amount, but youll have to call Pie to finalize your quote.

However, if other types of business insurance are higher on your priority list, consider different insurance companies. Pie refers shoppers to third parties for business owners policies, commercial auto insurance and more.

Integrate With Payroll And Improve Cash Flow

What would you do if you had extra cash to put back into your business? ADPs Pay-by-Pay Premium Payment Program** is a unique solution that offers your company a simple and efficient way to pay your premium:

- No upfront premium deposit is required****, which may free up funds that you can invest in your business

- Premium payments are based on actual, not estimated, payroll data and carrier rates, to minimize over or underpayments at your year-end audit

- Payments are spread over your companys payroll cycle so you know what to expect and when

Compare ADP’s Pay-by-Pay to traditional premium payment programs.

|

Traditional Premium Payments |

|---|

Learn more about our Pay-by-Pay® Premium Payment Program.

Pie Insurance Launches Workers Comp Coverage For Small Businesses In Seven States

Company Offers Ease, Savings, And Convenience for Small Businesses Shopping Online for Workers Comp

WASHINGTON—-Pie Insurance today announced it has begun selling workers compensation insurance policies online, directly to small businesses in Arizona, Colorado, Georgia, Illinois, Louisiana, Tennessee, and Texas. Small business owners in these states can now enjoy the convenience of online shopping for workers comp insurance while gaining the savings passed on through a more efficient insurance model.

Small business owners shoulder an unfair burden, with our proprietary data suggesting that 80% overpay for workers compensation insurance by up to 30% as a result of most insurance companies antiquated business models, said John Swigart, co-founder and CEO of Pie. Small business owners are hard-pressed to find a quick, convenient, fairly-priced workers compensation insurance offering. Pie has simplified traditional, cumbersome processes that add time and complexity to the purchasing process.

Workers compensation insurance is required by any company with full-time W-2 employeesin every state other than Texas, limiting the incentive for insurers to improve the customer experience or remove friction from the buying cycle.

Easy as Pie

“Were building a company that allows small business owners to purchase workers comp insurance easily through Pies straightforward online process so they can quickly move on with their day,” said Swigart.

About Pie Insurance

Recommended Reading: Key Lime Pie The Profit

Alternatives To Workers Comp Insurance Companies

Business owners who cannot find workers compensation insurance from a private carrier typically have a couple of choices, depending on their state. The first is the state-run fund, an organization often run by the states commerce or labor department that provides workers comp to businesses in high-risk industries or with large losses.

Business owners who cannot find coverage in the private market or the state fund can usually turn to an assigned risk plan. This is sometimes called a market of last resort. In monopolistic states, Ohio, North Dakota, Wyoming, and Washington, employers are required to use the state insurance fund to ensure that all coverage meets state labor requirements.

Let A Richmond Workers Compensation Attorney Be Your Advocate

Workplace accidents can be stressful and demoralizing events. You rely on your job to support yourself and your family, and it seems unfair that your ability to do so is imperiled by an accident at work.

These situations are exactly the purpose of workers compensation insurance. A successful claim will cover all necessary medical treatment, temporary payments for any time missed at work, and even lump-sum settlements in many situations.

However, denials of benefits are common. Whether this is the result of incomplete paperwork, a lack of connection between the condition and work, or some other reason, a Richmond workers compensation lawyer could help. They can work with you to evaluate the stated reasons for denials, gather strong evidence, and pursue claims and appeals that may be necessary to get you the benefits that you deserve. Contact an attorney today to get started.

Read Also: Impossible Chicken Pot Pie

Pie Insurance Business Insurance Review

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a referral fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Business Insurance: Hiscox, Insurance321, CoverWallet, Simply Business, CyberPolicy, and Thimble.

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

For example, when company ranking is subjective our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don’t click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process,

We’re Proud To Be Rated Excellent On Trustpilot By Our Customers

From Alaska to Florida, our customers represent small businesses of all kinds. They use their expertise to serve their communities and provide excellent service to their customers. We’re honored to support them in protecting their employees and businesses.

Learn More

“It was a simple and fast processI got exactly what I was looking for and at a great price.”

“Although I have a small business in terms of number of employees and policy size, they make me feel valued, and that is a testament to your company and how it values its clients.”

“My experience with Pie has been very positive. All of the employees have been personable, polite, professional, patient, in addition to being knowledgeable.”

Read Also: Impossibly Easy Chicken Pot Pie Bisquick

Pie Insurance Now Available For Small Businesses In Vermont And Rhode Island

Pie Insuranceone of the nations leading insurtechs providing workers compensation insurancehas been approved to serve small businesses in Rhode Island and Vermont.

Pie has seen fantastic growth throughout 2019, said John Swigart, CEO of Pie Insurance. In January, Pie provided workers compensation coverage in 10 states. Now in October, that number has jumped to include 31 states and Washington, D.C. With our launches in Rhode Island and Vermont, were able to help small business owners in these states save up to 30% on workers compensation insurance with an online process that is truly as easy as pie.

Workers compensation insurance provides medical, disability, survivor, burial, and rehabilitation benefits to employees who are injured or killed due to a work-related injury. Pies research suggests that 80% of small businesses overpay for coverage.

Rated Excellent by Small Business Owners

Getting workers compensation should be easy, and for Pies customers, it is. Small business owners around the nation continue to validate the companys mission to simplify workers comp insurance, rating Pie Excellent on Trustpilot.

Rhode Island Workers Compensation

Vermont Workers Compensation

About Pie Insurance

Next Post

Pie Insurance: Pros And Cons

|

Pros |

Cons |

|---|---|

|

Option to pay as you go for your workers comp premium through your payroll provider, as well as monthly, quarterly, semiannually or annually. |

Getting a certificate of insurance can take up to two days. |

|

Workers comp claims are managed through CorVel, an established company that has a national network of medical providers. |

Pie refers shoppers to third parties for other types of business insurance. |

|

Can get a price estimate online in minutes. |

No weekend customer support. |

Don’t Miss: Pyrex 8 Inch Pie Plate

Customer Satisfaction Rating Of Pie Insurance

Since Pie is too recent to appear on J.D. Powers Small Commercial Insurance study, well look to other sources.

Pie has an average of 4.6 out of five stars, based on 212 reviews on Trustpilot. Most of the reviews are positive , with 4% giving them one star and the rest in between. The positive reviews praise how easy Pies application process is , how fast customer service addresses their concerns, and they saved money. The one star reviews remark on customer service, price and processing.

The BBB seems not to have heard of Pie, so the reviews on Trustpilot are the only indication we have of what Pies customer service is like.

> > MORE: Next Insurance Review Thimble Insurance Review Vouch Insurance Review

Pie Insurance: Sme Cover Is Overdue An Online Transformation

The US-based Pie Insurance was founded in 2017 with a mission to make workers comp as easy as pie hence its name.

Partnering with local, regional and national insurance agencies, the company claims that it can save small businesses as much as 30% on premiums. Quotes can be generated online in three minutes and Pies services are available in 38 states.

The quality of its services has not gone unnoticed: Pie currently holds a score of 4.5 on Trustpilot, has featured on the , and has raised over $300m in capital so far.

You May Like: Damgoode Pies Cantrell

Digital Experience Rating Of Pie Insurance

You can get a quote on workers compensation insurance online, but youll need something called class codes. In order to provide you with a quote, they need to know what your employees do and what risks they might be exposed to. Someone who works in construction is exposed to more risk than someone who works in a nail salon. Riskier jobs pay higher premiums.

Why cant they just ask you what your employees do? Actually, workers compensation is regulated by the National Council on Compensation Insurance and some states have their own codes, so it varies, but they were created to provide some consistency across industries.

Youll also need to provide your annual payroll, which includes wages, salaries, bonuses and overtime. Location and claims history are also considered. Once you have all this information, Pie claims they can give you a quote in less than three minutes and save you about 30%.

If you need another type of business insurance, Pie will redirect you to either Progressive or to Hiscox. Progressive and Hiscox do offer online quoting as well.

> > MORE: How Much does Workers Compensation Insurance Cost?

If you are looking for the best cyber insurance for your company, be sure to shop around with a few companies or with a digital broker like CoverWallet, Simply Business, or commercialinsurance.net to compare several quotes to select the best one for you.

Dont Wait For Workers Compensation Certificates Of Insurance

Your business doesnt have to pause when you need proof of workers compensation. Keep your employees working and your jobs moving along with easy, 24/7 access to certificates of insurance.

ADP customers with RUN Powered by ADP® who also use ADPs Pay-by-Pay® Premium Payment Program** can access certificates by:

Don’t Miss: Damgoode Pies Fayetteville

Liberty Mutual: Best Workers Comp Insurance For One

Liberty Mutual* is a household name for personal insurance, but its also a top-10 provider of business insurancemaking it a convenient one-stop-shop for all your insurance needs. This carrier focuses on a positive customer experience, making everything from getting quotes to filing claims as straightforward as possible.

| Liberty Mutual Strengths |

|---|

*Liberty Mutual quote provided by our partner Commercialinsurance.net.

Pie Insurance Brings Future Of Workers Compensation To Four New States

Pie Insurance today announced it has begun providing workers compensation insurance to small businesses in Mississippi, New Hampshire, Utah, and West Virginia. Now Pie offers coverage in 29 states and the District of Columbia to an audience of 4.1 million small business owners.

With our exclusive focus on small businesses, Pie is reaching a community that had previously been underserved, said CEO and co-founder, John Swigart. Small businesses across the nation are in need of workers comp coverage that meets their unique needs, and we are excited to extend our services to Mississippi, New Hampshire, Utah, and West Virginia.

Since selling its first policy in 2018, Pie Insurance has disrupted the industry with its approach, which includes providing small business owners with an easy online quote process and flexible payment plans.

As a managing general agency for Sirius American Insurance Company, Pie provides A.M. Best A rated workers compensation insurance. Pies policies are backed by significant financial strength and tailored to small business customersoften saving them up to 30%.

With over $61 million in funding and an experienced team of executives, Pie expects to bring its easy as pie workers comp approach to small business owners nationwide by the end of 2019.

About Pie Insurance

You May Like: Sing And Dance Pinkie Pie

Biberk: Best Workers Comp Insurance For Quick Online Coverage

biBERK, backed by parent company Berkshire Hathaway, offers quick, excellent workers comp insurance policies in most locations across the U.S. A primary objective of biBERK is to take the strength of an insurance powerhouse and distill it into a simple process of buying and administering insurance online. biBERK offers fast workers comp coverage to business owners who need to cover new hires to meet legal requirements.

| biBERK Strengths |

|---|

Pie Insurance Brings Future Of Workers’ Compensation To Four New States

Pie Insurance today announced it has begun providing workers’ compensation insurance to small businesses in Mississippi, New Hampshire, Utah, and West Virginia. Now Pie offers coverage in 29 states and the District of Columbia to an audience of 4.1 million small business owners.

“With our exclusive focus on small businesses, Pie is reaching a community that had previously been underserved,” said CEO and co-founder, John Swigart. “Small businesses across the nation are in need of workers’ comp coverage that meets their unique needs, and we are excited to extend our services to Mississippi, New Hampshire, Utah, and West Virginia.”

Since selling its first policy in 2018, Pie Insurance has disrupted the industry with its approach, which includes providing small business owners with an easy online quote process and flexible payment plans.

As a managing general agency for Sirius American Insurance Company, Pie provides A.M. Best A rated workers’ compensation insurance. Pie’s policies are backed by significant financial strength and tailored to small business customersoften saving them up to 30%.

With over $61 million in funding and an experienced team of executives, Pie expects to bring its “easy as pie” workers’ comp approach to small business owners nationwide by the end of 2019.

About Pie Insurance

You May Like: Peach Cobbler With Frozen Pie Crust