Factors That Affect Your Credit Score

Other factors that can contribute to your credit score include the amount of credit you have available vs. how much credit you use . How many credit accounts you have open and how long they have been open for, any new accounts you may have opened, and the number of hard inquiries youve initiated into your credit report.

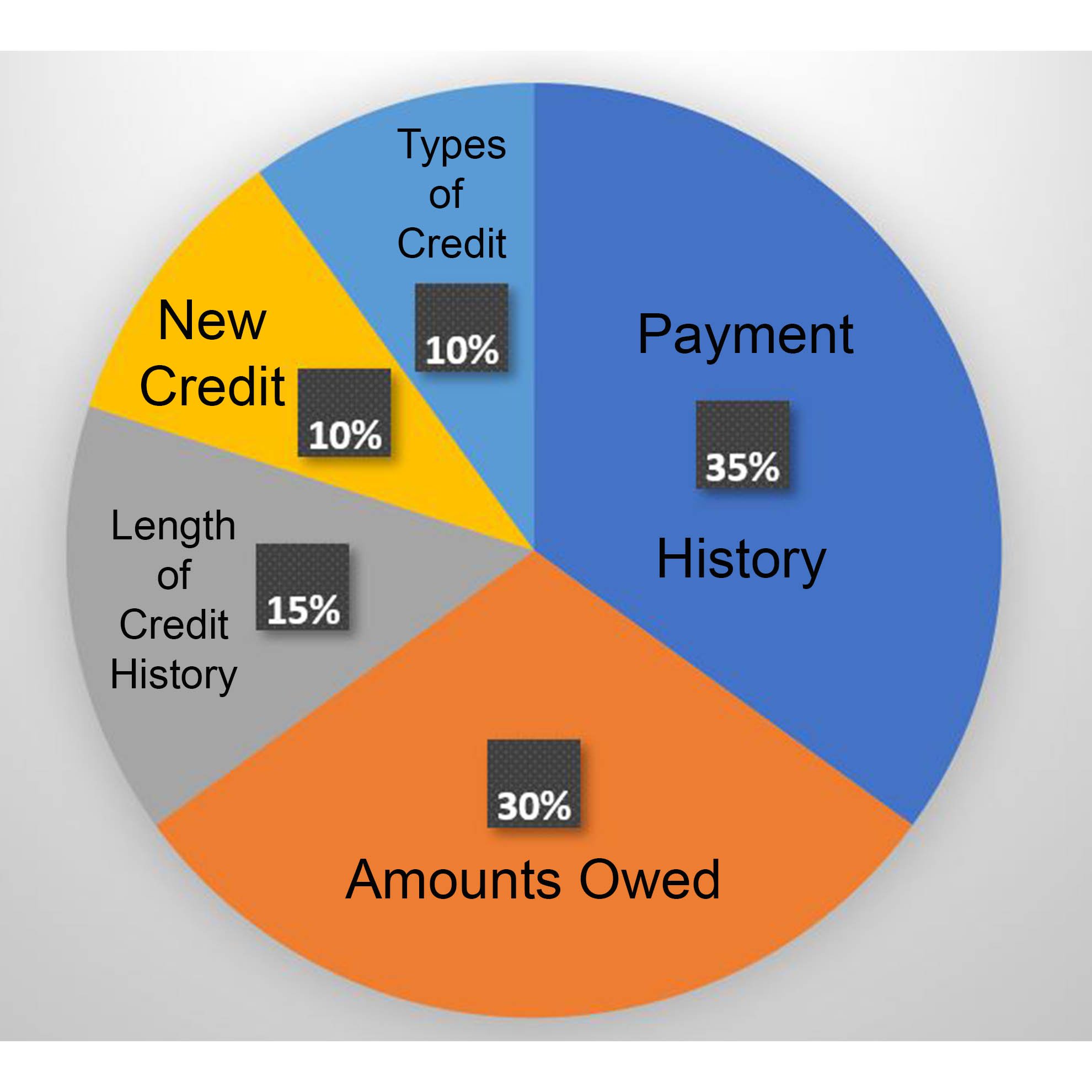

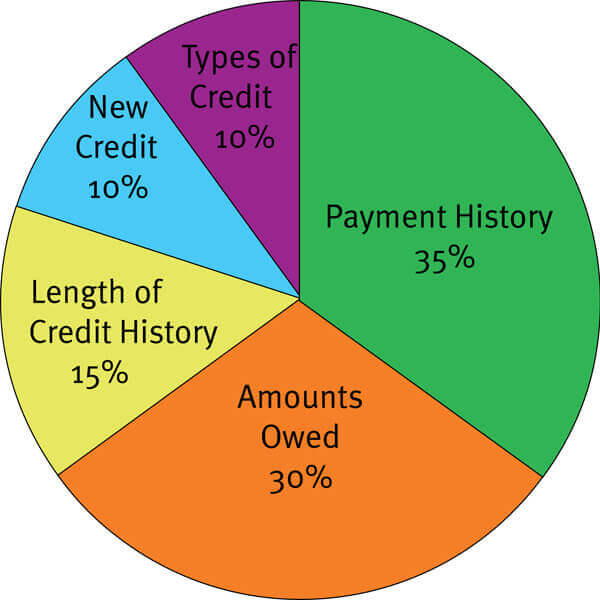

The Five Pieces Of Your Credit Score

Your credit score is based on the following five factors:

Ultimately, the best way to help improve your credit score is to use loans and credit cards responsibly and make prompt payments. The more your credit history shows that you can responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Do Not Go Beyond The Limit

Some credit cards allow you to charge your card beyond your initial credit limit. They will let you do it and then charge you an “over the limit” fee on the next billing cycle. The average “over the limit” fee is approximately $35. If you want to use credit score best practices, then you will never go over your credit limit. Potential lenders and creditors look at your spending history and balances owed. They can see when you go over your limit, and it can affect their image of you. It’s better to find other ways to buy the items you desire. Take a few weeks and save up the money for something you want instead of going over your . The practice will help you to stay in good graces with all of your creditors.

Also Check: Navy Bean Pie Recipe

How Are Credit Scores Calculated

Reading time: 4 minutes

Highlights:

-

Payment history, the amount of credit youre using, and the length of your credit history are factors included in calculating your credit scores

While your credit score is important, it is only one of several pieces of information an organization will use to determine your creditworthiness. For example, a mortgage lender would want to know your income as well as other information in addition to your credit score before it makes a decision.

How Do I Find My Credit Score

Today, there are a number of options to help you stay on top of your credit score. Many credit cards will feature your credit score on your monthly statement, and most of the major banks with checking and savings accounts offer to provide your score as a value-added service. Even student loan lenders such as Sallie Mae offer a free or low-cost monthly monitoring service so you can take control of your credit. But if you want to dig more in-depth into your credit health, you may need to work with the credit reporting companies directly.

To clarify, by law you are entitled to one free report every 12 months from each of the three credit reporting companies. If youre interested in achieving and maintaining good credit, you should definitely take advantage of this. But getting a free copy of your credit report does not necessarily mean it will include your actual credit score. You may pay to view your credit score, or you may be offered a view of your credit score through one of your creditors.

There are some credit monitoring tools and services you can subscribe to for a few. These services can keep you alert to any inaccurate or fraudulent activity on your accounts. If youve been struggling with a low credit score and youve been working hard to raise it, monthly monitoring may help keep you motivated as you see that number get higher and higher!

Recommended Reading: Campbell’s Pot Pie Recipe

Example Of Data Structure

| West | 263 391.13 |

Data for a pie chart can be summarized in a table like the above, where the first column indicates a category, and the second the proportion, frequency, or amount of that category. Usually, the total does not need to be specified separately unless it is to be listed somewhere else on a generated figure. Alternatively, some tools can just work with the unaggregated data as in the below table, essentially performing the aggregation into the table above at time of pie chart creation.

Only Use Your Credit For Emergencies

You can preserve your credit by only using your credit cards for emergency purposes. You should never use them for frivolous purchases or items that you can buy with cash. If you save your charges for emergencies, then you’ll always have available credit when serious circumstances come up. People who have high credit scores use this strategy as one of their credit score best practices.

Recommended Reading: Church’s Apple Pie

Keep Your Information Up To Date

You should also make sure that tall of your personal information is up to date when you order your credit report. Make sure that your name is correct and that the bureaus have your most recent address on record. Request an update if any of the information is incorrect.

The Creditry Store – Your New Best Source of Information and Knowledge

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

You May Like: Key Lime Pie Company The Profit

Monitor Your Financial Health

- FICO® Scores take into consideration all of these categories, not just one or two.

- The importance of any factor depends on the information in your entire credit report.

- FICO® Scores look only at the credit-related information on a credit report.

- FICO® Scores consider both positive and negative information on a credit report.

See What’s In Your Credit Report

Check your credit report annually for errors. Not only will it help you correct any errors you may find, but it will help in monitoring for identity theft. Visit www.annualcreditreport.com for a free credit report.

Make your credit payments on time.

Sounds simple, but paying your bills on time is one of the most important aspects of your credit history. Set up automatic payments if necessary.

Pay off your credit cards.

This is one of the best ways to improve your credit history. Do not just shift your credit balances from card to card. Pay down your debt and keep it down. Keep your credit account open to maintain a positive history.

Maintain low credit balances.

Once you pay off your credit cards, don’t use them to buy anything you can’t afford to pay off at the end of the month. Do not exceed more than fifty percent of your available credit per card.

Be credit wise.

If you have open credit account, use it responsibly and don’t use it to excess. Remember, credit scoring rewards borrowers who can manage credit, not people without any credit experience.

Also Check: Supreme Bean Pie Recipe

What Is Considered Good Credit Utilization In Canada

When we think about credit scores, many Canadians dont consider credit utilization to be a primary factor. We tend to be more concerned about making payments on time because that obligationand its impact on our credit profileis more clearly understood. But to ensure our credit score doesn’t drop because of “high credit utilization” it’s important to understand what it is and what you can do to manage it.

Straight Talk About The Fico Pie Chart

Fair Isaac Corporation developed FICO® Score models to rate a consumers credit history. Since 1989, the company has developed many different scoring models to sell to lenders and consumers.

A pie chart is often used to explain factors that impact a FICO Score. There are 5 pie pieces: payment history, amounts owed, length of credit history, new credit, and credit mix. Each piece is allocated a percent of the pie.

The 2 largest pie pieces are payment history and amounts owed. Payment history is a consumers record of paying accounts as agreed. Amounts owed compares total amount of available credit and amount being used. Example: Pete has 2 credit cards with $5,000 limits on each . Each billing cycle he charges $5,000. Petes credit utilization is 50% and higher than the recommended 30% or less.

The other 3 pie pieces length of credit history, new credit, and credit mix are smaller pieces. A long history of paying as agreed can boost a score. If that history includes a mix of installment and revolving accounts that provides another boost. Applying for too many lines of new credit in a short time-frame can have a negative impact.

A consumer can access free credit reports at www.annualcreditreport.com The free reports do not include a score. They do provide payment history and credit utilization.

You May Like: Sweetie Pies Baked Beans Recipe

Factors That Do Not Affect Credit Score

It is illegal for credit scoring formulas to consider race, religion, color, sex, marital status or national origin. Credit scoring formulas also may not take into consideration your age, where you live, or soft credit inquiries.

Your occupation, salary, employer and employment history are not factors that affect your credit score, however, lenders may factor in this information when making credit approval/denial decisions.

The Best Office Productivity Tools

Kutools for Excel Solves Most of Your Problems, and Increases Your Productivity by 80%

- Reuse: Quickly insert complex formulas, charts and anything that you have used before Encrypt Cells with password Create Mailing List and send emails…

- Super Formula Bar Reading Layout Paste to Filtered Range…

- Merge Cells/Rows/Columns without losing Data Split Cells Content Combine Duplicate Rows/Columns… Prevent Duplicate Cells Compare Ranges…

- Select Duplicate or Unique Rows Select Blank Rows Super Find and Fuzzy Find in Many Workbooks Random Select…

- Exact Copy Multiple Cells without changing formula reference Auto Create References to Multiple Sheets Insert Bullets, Check Boxes and more…

- Extract Text, Add Text, Remove by Position, Remove Space Create and Print Paging Subtotals Convert Between Cells Content and Comments…

- Super Filter Advanced Sort by month/week/day, frequency and more Special Filter by bold, italic…

- Combine Workbooks and WorkSheets Merge Tables based on key columns Split Data into Multiple Sheets Batch Convert xls, xlsx and PDF…

- More than 300 powerful features. Supports Office/Excel 2007-2019 and 365. Supports all languages. Easy deploying in your enterprise or organization. Full features 30-day free trial. 60-day money back guarantee.

Office Tab Brings Tabbed interface to Office, and Make Your Work Much Easier

Read Also: Pienation

Every Credit Score Is Different

Keep in mind that although each credit score utilizes information from all five categories, each credit history is calculated uniquely. The percentage breakdown of each category is a general rule, but may be different from one individual to the next. It’s impossible to predict how much weight to give any one given factor of your history. Your best bet is to display positive credit behavior over time.

Understanding Your Credit Scores

First off, you have more than one credit score, and there are a few reasons for that.

There are different scores for specific products. For example, there are special auto and home insurance credit scores. There are also different credit-scoring models, like FICO and VantageScore, which means you could have scores according to each model. Even the same model could give a different score depending on whether it uses data from your Equifax, Experian or TransUnion credit report.

Lastly, there are multiple consumer credit bureaus that provide on which scores are based. So depending on what information each bureau gets from individual lenders and that can differ the data used to compile your reports and build your scores could vary from bureau to bureau.

When you put it all together, that means that each individual could have multiple scores, and sometimes they dont match. Its difficult to pinpoint exactly how many scores you may have, but it could be hundreds.

Even though there are many different credit scores out there, its worth knowing the general range that your scores fall into especially since they can determine your access to certain financial products and the terms youll get.

FICO and VantageScore Solutions create the most widely used consumer credit scores, and these companies update their scoring models from time to time.

Recommended Reading: The Original Key Lime Pie Company

How To Reduce Your Credit Card Debt

You cant get ahead by paying 18% Charlie Munger, Vice Chairman of Berkshire Hathaway & Investing Legend

Since nearly a third of your FICO scores are based upon the amounts owed on your outstanding debts you could still potentially be facing significant credit score problems even if you routinely pay all of your bills on time. Making a plan to eliminate your credit card debt is a great step toward earning the stellar credit scores you want and need to lead a better life.

For this reason, we recommend using a technique that Dave Ramsey, one of the most famous personal finance gurus, calls snowballing. This method is where you pay off the smallest balances first, and then slowly work your way up by paying off each credit card one by one. You commit as much money as you can to paying down your debt and, over time, the snowball gets bigger and bigger, allowing you to pay more debt off.

How Are Credit Scores Determined

A credit score is a number that indicates your perceived creditworthiness in the eyes of credit rating companies, banks and other financial institutions. If you have a history of paying your bills on time and only using a small percentage of your available credit, you should have a high score. If youve missed bills, filed for bankruptcy, defaulted on loans or dealt with collections, then your score will likely be lower.

Heres a deeper breakdown of what goes into the creation of your credit score:

- Payment history: 35% of your score

- 30% of your score

- 15% of your score

- New credit applications: 10% of your score

- 10% of your score

The most well-known provider of credit scores is the Fair Isaac Corporation, or FICO. However, each of the three credit bureaus has its own take on your score. This is known as a VantageScore, and it is a modified version of your FICO score thats based on both the credit bureaus scoring models and their own information on your credit history.

There are also different FICO credit scores for bank cards, auto loans and more. Thats why a single person can have several credit scores. Different bureaus may treat credit events or authorized user accounts differently, so you may have excellent credit according to your Transunion credit score, but still be in the good range with your Equifax score.

You May Like: Campbells Chicken Pot Pie With Pie Crust