New Year New Pie Chart

Doing this thinking at the end of the year is ideal because you can reflect on the past years distribution of your take home pay spending as a starting point to plan for next year. Think to yourself, when you do this exercise in December a year from now, what do you want your budget pie summarizing next year to look like? What things do you aim to change in this new year to make the next pie look differently one year from now?

Lets start with where we are today. Take your high level budget, the amounts of each main bill : mortgage/rent, utilities/phones, insurance, childcare, and any others, as well as your debts , your discretionary spending cap, and saving target. If you havent done this, before check out this post to help you seamlessly establish your monthly numbers.

Theres no need to make this a mathematical masterpiece so go ahead and just draw something by hand in your planner, journal, wherever you like to do your doodling.

Never Ask Again: Where Does All The Money Go

Experts are always telling us that to get a handle on our spending we must our record our expenses. But who wants to fiddle with devising a system or learning complicated software?

With this low-tech but high-functioning chart, all you have to do is click .

I created a version of this chart in my first months of marriage when it seemed as if our money was being sucked into a black hole. Weve been using it every month since.

When we first started, I had to keep reminding my husband to write down anything he spent from cappuccino to bus fare. But he got used to it, and now he reminds me!

We have been tracking our daily spending for ten twelve years. Its fascinating to see our pennies roll into the little compartments, and it has changed the way we think and behave about spending.

Embed In Presentations Reports And More

Canvas pie charts can be embedded in all kinds of graphics and documents. Weve got tens of thousands of templates to choose from, so you can keep a consistent, stylish look. Simply choose what youd like to make whether its a presentation, an infographic or something else then select a template. Add your pie chart from the side panel in Canvas editor.

When youre all done, you can download your pie chart as a JPEG, PNG or PDF file, share it on your social media, or email it directly to someone.

Also Check: Bisquick Impossibly Easy Chicken Pot Pie

Are The Dave Ramsey Budget Percentages Realistic

Even Dave Ramsey, famous for making rules of thumb into hard and fast edicts, says that these budget percentages are just a guideline to get started. You may have to adjust certain categories up or down to fit your particular situation.

Curious about what the average American spends vs. Dave Ramseys budget percentages? Check out these budgeting and spending statistics for more info.

The Easiest Way To Use The Guidelines

To make budgeting easier, weve built these budgeting guidelines into an Excel Budgeting Calculator Spreadsheet provided through our educational website, MyMoneyCoach.ca. Its free and easy to use even if youve never touched Excel before. If you dont have Excel on your computer, you can also download it for the Mac or OpenOffice .

As you enter your living expenses, the interactive spreadsheet will calculate all the spending guideline numbers for you. It also visually compares your spending in each category to these guidelines so that you can see how youre doing. As you fill out the budget spreadsheet with your living expenses, it warns you if youre going over the guidelines in any area of your budget and shows how your spending falls into these guidelines. It also suggests spending amounts for every budgeting category listed above based on your income and family size. When youre done, it shows you what your budget looks like in a pie chart divided into the various expense categories.

On top of all this, the budgeting calculator offers you tons of helpful suggestions and tips along the way so that you can avoid the common pitfalls of the budgeting process.

You May Like: Campbell Soup Turkey Pot Pie Recipe

Where Does The Money Come From

State government resources can be grouped into several categories: taxes, grants, fees, sales, earnings, transfers, and balances. For the 2020-2022 biennium, total state resources available for appropriation are projected to equal $141.3 billion, including year-end balances, transfers, and bond proceeds.

Total revenues from all tax sources are projected to be $54.7 billion. Tax revenues include $31.5 billion from individual income taxes and $5.9 billion from motor vehicle and highway taxes. Other large revenue sources for the biennium include $31.3 billion in federal grants and 18.6 billion in institutional revenue, primarily fees collected at colleges and universities, medical and mental hospitals, and correctional facilities.

For budgeting purposes, state revenues are divided into two broad types: the general fund and nongeneral funds.

More than half of state revenues are “nongeneral funds,” or receipts set aside for specific purposes. For example, motor vehicle and gasoline taxes are earmarked by law for transportation programs, student tuition and fees must support higher education, and federal grants are designated for specific activities.

General fund revenues make up 32.8 percent of the budget. They are mostly derived from direct general taxes paid by citizens and businesses in Virginia. Because general fund revenue can be used for a variety of government programs, these are the funds that the Governor and the General Assembly have the most discretion to spend.

Customizing Your Budget Pie Chart

The default chart that pops up for Google Sheets is usually a bar or line chart. You can customize the style as well as the chart title, slice colors, labels, and much more in the chart editor. I prefer a donut style chart .

You can move the chart around to an appropriate position on the Pie Chart sheet.

The last little finishing touch for this budget pie chart is the date reference information. When you visit your pie chart sheet its helpful to know which month of data youre actually reviewing in your budget.

In Cell D1 and E1 respectively add the following formulas which will pull in the selected month and year from the Monthly Budget sheets dropdown selector:

='Monthly Budget'!H3='Monthly Budget'!H2

If you want to review a different months top 10 expenses, just select a different month on the Monthly Budget sheet.

You can include more than the top 10 expenses if you like, I just prefer limiting it to the top 10 because the pie chart can get a bit unwieldy if you have a lot of categories and spending in a particular month.

Recommended Reading: Campbells Chicken Pot Pie With Pie Crust

You Will Lol At This Ridiculously Unrelatable Monthly Budget Of A 25

CNBC shared a rather, er, unbelievable pie chart showing a typical monthly budget of a 25-year-old who earns $100,000 a year, and instantly, the internets collective mouths pursed into a teeny-tiny butthole. Yes, you read that correctly: a 25-year-old and $100,000 a year.

But its how this $100K is spent thats a real head-scratcher.

RELATED: How To Make Money In College: 25 Ways Not To Be A Broke Undergrad

If youve ever wondered how a person making six-figures spends their dolla-dolla bills, yall, this pie chart is apparently it. After paying off his $40 cell phone bill , this particular dude spends $615 A MONTH in donations.

The budget breakdown of a 25-year-old who makes $100,000 a year and is excellent with money. via

CNBC

Now, I say one particular dude because the story was actually highlighting one special 25-year old who is excellent with money.

Apparently, Trevor Klee is a Boston-based entrepreneur who works as a test prep instructor, a business he founded himself after graduating from Princeton. He tutors people for the GMAT, GRE and LSAT. Its one of those weird skills that turned out to be really monetizable,he tells CNBC Make It.

But back to the pie chart. In addition to this unicorn-like $40 cell phone, he also only pays $20 for the internet and $825 for rent. Sure Trevor, sure you do.

Of course, most everyone on Twitter had a reaction and didnt see the fine print of the corresponding article .

But, I digress.

What Does Your Budget Pie Look Like

Originally published in Military Spouse Magazine

I was chatting with a colleague the other day about a big challenge in our work as financial planners. Frankly, there’s not a lot of new stuff out there when it comes to giving guidance about helping people manage their money. It’s more about packaging the principles in a way that helps make the fundamentals take root and grow into sound family financial practices.

Then I had a chat with Debi, a military spouse who is part of the Accredited Financial Counselor program. She told me about a class she was presenting on her installation. At the core of her presentation was the idea of creating a spending pie — a guideline to assess if your spending habits are a help or hindrance as you strive for personal financial freedom. Voila — an idea for this month’s column! Thanks Debi.

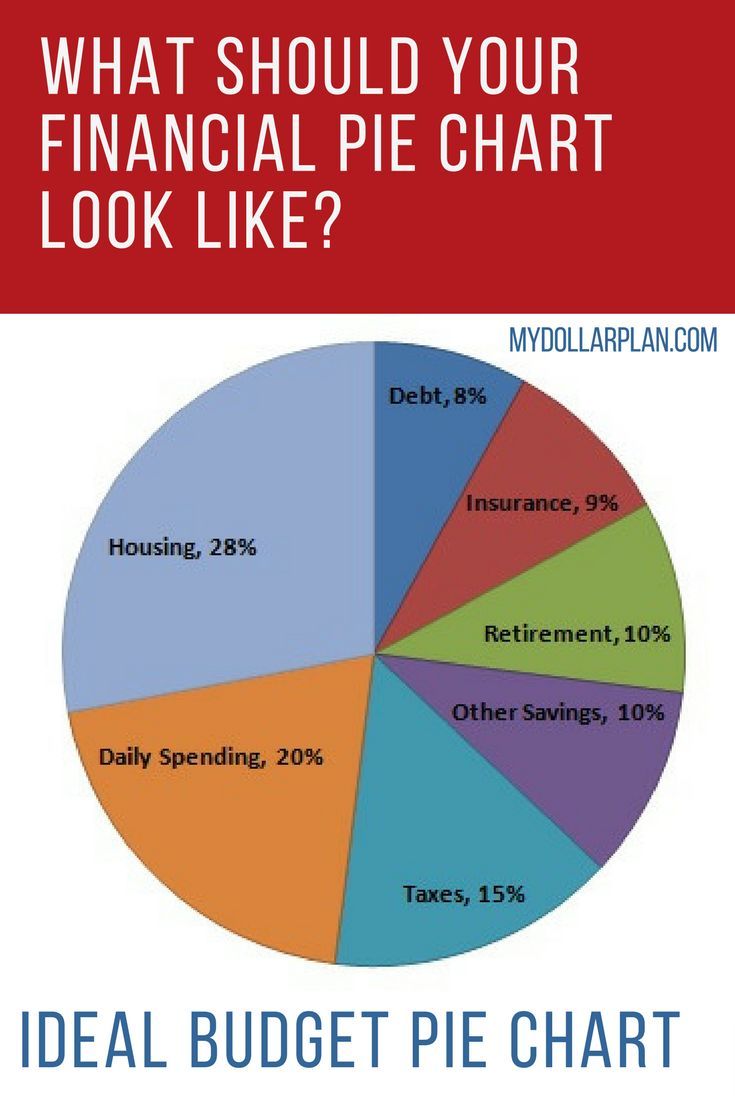

If you want to see how Americans spend their money, check out the annual Department of Labor Consumer Expenditure Survey. However, my goal here is to map out some guidelines as to where your money should go, not where it actually goes. Using an annual household income of $60,000, here’s how I broke it out on a monthly basis:

20% Housing : This includes the core of what it takes to put a roof over your head. Mortgage and/or rent. This may be lower than what a lender will lend, but too many folks are house rich and cash poor. Check that, they were house rich.

You May Like: Pinkie Pie Chicken Toy

Adding A Pie Chart To Your Budget Spreadsheet

First, add a new sheet to your Google Sheet. Click the plus sign in the lower left corner of your Google Sheet to add a tab. Double click the new tab to rename it Pie Chart.

In column A, enter the following query into row 1:

=query

This should bring in a list of expense categories and their actuals ordered by highest to lowest by amount value.

This simple Google Sheets query works because the information we need for our budget pie chart is on the Monthly Budget sheet in hidden columns T through W.

The query is just leveraging the calculations the Monthly Budget sheet is already doing. We only want to pull in spending data for categories that are expense types, which is customized on the Categories sheet. And since we want to see the top 10 spending categories, were ordering the expense actuals from highest to lowest, or ascending.

Now, lets reformat the amounts so the pie chart can use them. In Column C, row 1 add a header called Amount. Then enter the following formula into row 2 in column C.

=arrayformula)

This is going to change the negative amount values to absolute values. For whatever reason, pie charts dont like negative amounts so without this step your chart comes up empty.

Right click the column B header and choose Hide to hide this column. We dont really want to see it and hiding it will make creating the pie chart for our budget easier.

Make Your Own Pie Chart

You can use Excel to create a pie chart for you, or you can do one by hand. To use Excel, you can download the ideal pie chart worksheet and enter the numbers that apply to you.

If you want to make your pie chart by hand, do your best to break down your income into each of the categories named above. For each category, divide that amount by your total income, then multiply by 100. This will convert your spending in each category into a percentage. Draw a large circle and divide it in half. Draw four lines in each half to create 10 total sections. Each of these sections represents 10%. Fill in the chart using different colored pencils or markers, filling in portions of the 10 sections to represent categories that are more or less than 10%.

You May Like: Kermits Key Lime Pie Recipe

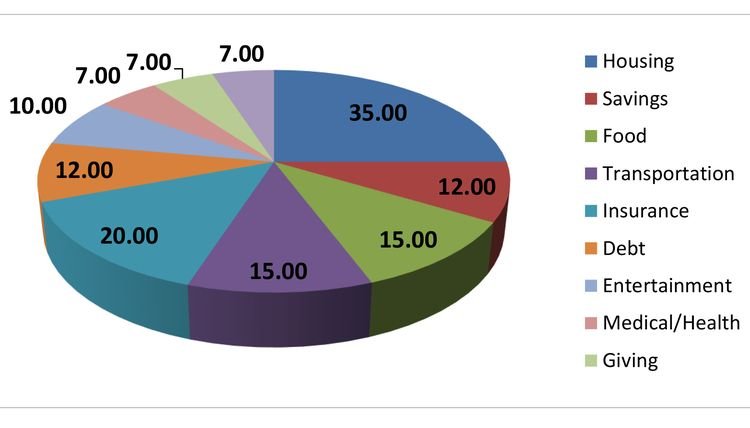

Breakdown Of Cost Of Living Budget Categories

- Housing: 35%35%35%

- Utilities: 5%5%5%

Examples of utility costs are cell phone, gas, and internet bills.

- Food: 10-20%20%20%

Groceries, personal care products, and things for baby needs are expenses youd include here.

- Transportation: 15-20%20%20%

Money you spend on public transit, taxis, fuel, vehicle insurance, maintenance, and parking are included in this category.

- Clothing: 3-5%5%5%

Shoes and clothes for all members of the family.

- Medical: 3%3%3%

This includes premiums, specialists, and over-the-counter medication.

- Personal & Discretionary: 5-10%10%10%

Money spent on entertainment, recreation, education, tobacco & alcohol, eating out, gaming, hair cuts, hobbies, and planned charitable giving are some examples. If you spend more in this category, make sure your budget balances by spending less elsewhere.

- Savings: 5-10%10%10%

Plan to save money for expenses that dont occur every month, as well as for your future. Then youll have extra available when you need it.

- Debt Payments: 5-15%15%15%

Many people find that their budget is quite tight when their monthly debt payments are over 20% of their net income.

Dave Ramsey Budget Percentages

Dave Ramsey has a lot to say about ideal household budget percentage guidelines. And its hard to argue with the success hes had in inspiring millions to get out of debt and live within their means. The Dave Ramsey budget percentages are a great tool to get your household budget on track.

One of the first steps to budgeting is actually making a budget.

Obvious? Yes. But its also where a lot of people seem to get stuck.

Thats why I found Dave Ramseys budget percentage guidelines so helpful when I first started tracking my spending. And while everyones situation is different, I think they are a good place to start.

Pssst Make sure you scroll all the way down to get your own free printable copy of Dave Ramseys budget percentages .

You May Like: Original Key Lime Pie Company

How To Create A Monthly Budget Online

Most people know that they should have a budget, but figuring out how to make one can seem complicated. How do you decide how much of your income goes to groceries versus entertainment? And how do you account for bills that change monthly, like your electric bill? Many people find that it helps them to have a visual representation of where their money goes. Making a pie graph can help you create a budget, stick to it and visualize your monthly expenses.