Calculate Your Total Monthly Bills Due

The first step is to write down all of your recurring bills in the first tab of the free monthly budget calculator.

It will help you to have everything in one place: the website of the company, the payment frequency, and its amount. For variable amounts, you can leave it empty, put an average or add the highest amount.

Then, This app will help you to pay most of your bills from your phone.

I added all of my bills in Prism:

- Automatically paid bills

- The ones I can pay within the app

- Bills that I can pay online but are not available on Prism

Prism will also help you to keep track of your monthly payments with nice graphs.

Once you have all of it set up, all you have to do is look at the app at the beginning of the month and write the amount of each bill in part 2 of the monthly budget calculator.

Sometimes, bills are not showing until later in the month so I look at the bills tracker to know which one I should expect to pay and their amount. The bills that I pay at the end of the month all have a set amount so I know exactly how much I need to pay.

The last step is to add any exceptional bills that you need to pay, such as, medical bills.

How To Create A Budget With Irregular Or Fluctuating Income

If your income fluctuates, creating a budget with irregular income can be challenging. To make things easier, try using one of these 3 strategies for creating a personal budgeting plan for irregular income. These practical strategies will give you simple but effective ways to make sure youre not spending too much in better months and have enough to spend in leaner months.

If youd like to learn more about how to plan for and budget with irregular income and even ask questions along the way, you can in one of our free online workshops.

Do you have questions?

Get debt help now

If you’re struggling and are wondering how to move forward, give us a call. We’re happy to answer your questions and help with any financial advice you need. It’s possible that all you need at the present time is the right information or a plan for how to move forward once your situation improves. Give us a call if you have any questions. Speaking with us is always free, confidential and non-judgmental.

Needs Vs Wants: How To Budget For Both

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Some things you need a roof over your head, electricity in your home, gas in your car to get to work and some things you just want, like tickets to a show or dinner and a movie. You can fit both into your budget and still set money aside for emergencies if you manage your spending with care.

Keep reading to learn how to balance financial needs and wants.

Recommended Reading: Chocolate Key Lime Pie On A Stick

How To Determine And Enter Your Income

The first step in the monthly budget calculator is to determine your monthly income. This will be the amount you can spend every month, so be sure to use your net income, not your gross income.

Gross income is what you make before anything is deducted from your paycheck. Net income is what you actually bring home after taking out taxes and any paycheck deductions for things like your retirement or your health insurance plan.

To determine what to enter under Salary/Wages in the budget calculator:

- If you get paid a regular check once a month, simply enter the take-home amount of that check.

- If you get paid twice a month, add the take-home amount of your two checks together and enter that amount.

- If you get paid every other week, multiply your take-home amount by 26 for the number of checks you get each year, and then divide by 12 to get your monthly take-home pay. Enter that amount in the budget calculator.

- If your income changes from month to month, add up your total monthly deposits for the last 3 months and divide that number by 3 to get a monthly estimate. Enter that amount in the budget calculator. If the last 3 months were unusually high or low, add up all your deposits for the past year instead and divide by 12 to get a better average.

If you have additional income such as a side job, child support, alimony, or other supplemental income, add the monthly amount you can spend in the monthly budget calculator under Other Income.

Where To Put Extra Money If Youre Under Budget

If you have money left over at the end of the month, congrats! Now you can really move your financial situation forward. Here are a few things you can doranked by importancewith that extra money.

- Put it in your emergency fund: While you had a good month now, it probably won’t always be that way. If you dont have a fully funded emergency fund, this is a great place to put that money.

- Pay down debt: If you have debt, nows a good time to knock some of it down. Debt with a high interest rate is generally better to pay off before lower-interest debt, since thatll save you more in the long run.

- Save it for later: If you have a savings goal youre trying to reach, such as saving for a house, that extra money can go a long way. You can also consider parking it in your retirement account.

Don’t Miss: Campbells Soup Recipe Chicken Pot Pie

Money Spending Calculator Worksheet

Budget Calculator for Trip

The word budget gains groans of torment frequently from a variety of people but there really is nothing to agonize over. A budget is simply a spending plan that includes everything you will need to spend money on. In fact that is the first budgeting tip. To make budgeting simple and easy, set a goal. Time frames give you a set of number to work with. Setting a goal is by far the most important budgeting tip.

Monitoring spending is helpful. This may seem to be a little bit tedious to do, but the results will really help get you on track financially. You accomplish two things by monitoring your spending habits. First, you will be able to confirm that your budget is accurate. If your budget calculations are off, then it will not be easy to stick with. Remember, a budget is not meant to be a constraint. You want to have a budget that reflects your actual spending habits. Second, you will be able to see some of your own common mistakes. Soon, you will see how little purchases can add up.

How To Start Saving And Control Spending Using A Budget

Do you ever wonder where all your money goes?

Is there more month than money to pay for it?

If this is your scenario then this Budget Calculator can help you take control of your money and get your savings back on track.

There are lots of free budget planners online that can help you create your first budget template. But before you jump in, make sure that you are ready with your list of inputs necessary for creating a budget.

Read Also: Bean Pie My Brother

Tips For Sticking To A Budget

Sticking with a budget isnt always easy. Here are some tips for how to stay with it:

- Reframe it as a spending plan: The word budget has a negative connotation for some of us. It sounds like your parents lecturing you when you were a child. So instead of thinking of it as a budget, think of it as a spending plan to help you get where you want to go.

- Do it often: Its harder to keep up with your budget if you wait too long between check-ins, because itll be harder to track down expenses and make sure everything adds up. Getting in the habit of checking in on your spendinglike every weekcan be a big help.

- Reward yourself: Give yourself a little extra motivation to follow your budget by setting up a rewards system. For example, if youre under budget or if you keep up with your budget for a few months in a row, you can reward yourself with something you can afford and appreciate.

- Set budget date nights: If you have a spouse or partner, make a point to check in with them regularly. You can even set up fun budget date nights so its not a chore.

How To Use This Budgeting Calculator To Improve Your Finances

This budget shows you how youre currently spending your money. Thats good for establishing a baseline, but you can take it a step further by playing around with the calculator and entering new numbers. For example, you can see how much youll have left over each month if you move to a cheaper apartment, spend less on groceries, or cancel that Hulu subscription.

Once youre happy with how much money you have allocated to each category, you can write these numbers down as a guide, but dont stop there. A plan is good in theory, after all, but it doesnt become real until you actually follow it. Track your spending against your budget each month with budgeting software programs or apps, or even just pen and paper.

Read Also: Campbells Soup Chicken Pot Pie

In Summation: Budget With One Thing In Mind

Everything in this post is what I consider really useful information for anybody who wants to create a dependable monthly budget.

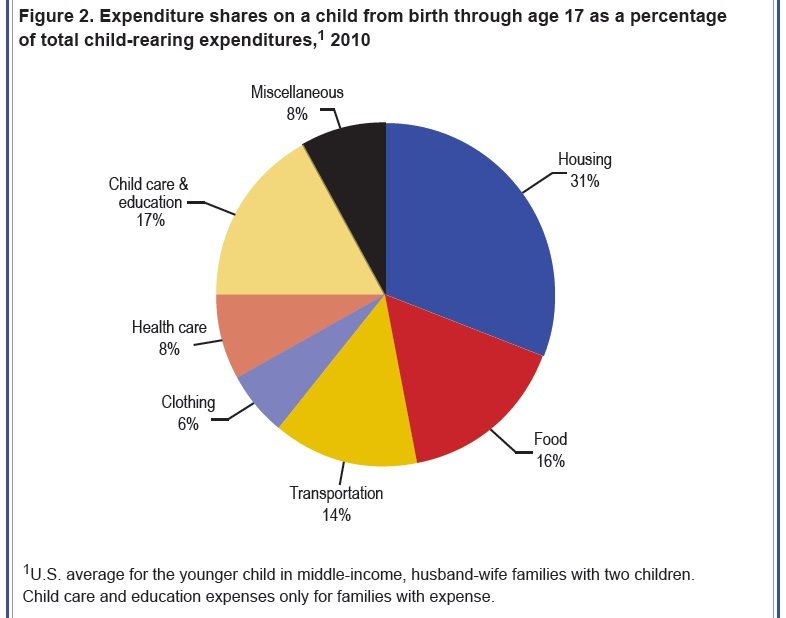

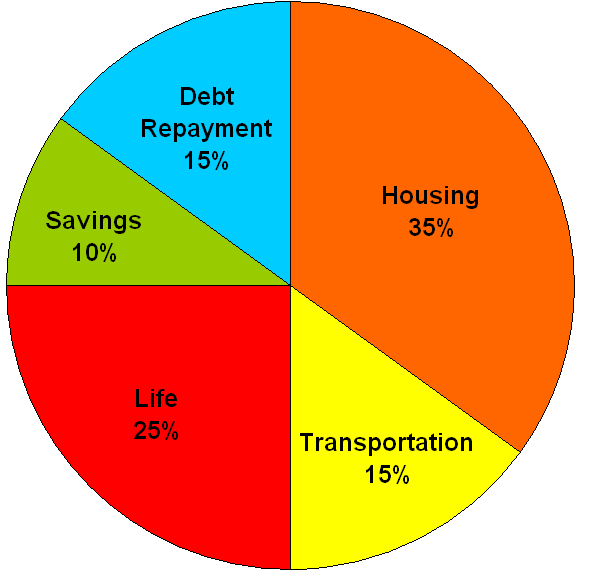

These percentages are a great outline for you to budget your expenses and keep track of your finances but remember that real life is not always as easy as math.

Your categories may need to be altered a bit and that is okay. Everyones situation and priorities are different. Housing may be more expense than 25%, you may not have childcare to pay off, you may have debt coming in by the truckload, etc.

While you may change things around a bit, it is important that you keep track of your expenses and have a system in place.

How To Determine And Enter Monthly Expenses

The rest of the budget maker is dedicated to capturing your monthly expenses. Some of these will be specific numbers. Others will be estimates.

This budget calculator guide will walk through each section, step by step.

Housing Expenses

Mortgage or Rent: Enter the amount of your monthly mortgage payment in the mortgage box, or the amount of your monthly rent in the rent box of the budget calculator.

If youre a homeowner and your property taxes are not included in your mortgage payment, divide those taxes by 12 and add that amount to your mortgage to make sure your property taxes are covered in your monthly budget.

HOA Fees: HOA fees are homeowners association fees, but the budget calculator is flexible, so you can use this box however you need to.

You can leave the box blank if it doesnt apply to you. However, you can also use it for things like storage rental fees, monthly pet fees or parking fees from your landlord, or any other home-related expenses that arent otherwise covered in this section of the budget maker.

Home insurance: Use this box for home insurance or renters insurance. If your home insurance is included in your mortgage payment, dont enter it again here. Each expense should only be captured once in the budget calculator.

Repairs/Maintenance: Most renters dont need to pay for repairs and maintenance on their rental property. If that applies to you, leave this section blank.

Transportation Expenses

Also Check: Campbell’s Chicken Pot Pie Recipe

The Easiest Way To Use The Guidelines

To make budgeting easier, weve built these budgeting guidelines into an Excel Budgeting Calculator Spreadsheet provided through our educational website, MyMoneyCoach.ca. Its free and easy to use even if youve never touched Excel before. If you dont have Excel on your computer, you can also download it for the Mac or OpenOffice .

As you enter your living expenses, the interactive spreadsheet will calculate all the spending guideline numbers for you. It also visually compares your spending in each category to these guidelines so that you can see how youre doing. As you fill out the budget spreadsheet with your living expenses, it warns you if youre going over the guidelines in any area of your budget and shows how your spending falls into these guidelines. It also suggests spending amounts for every budgeting category listed above based on your income and family size. When youre done, it shows you what your budget looks like in a pie chart divided into the various expense categories.

On top of all this, the budgeting calculator offers you tons of helpful suggestions and tips along the way so that you can avoid the common pitfalls of the budgeting process.

How To Determine And Enter Monthly Savings

Emergency Fund: This is where you add your monthly contribution to your emergency fund. If you decided to include things like home or car maintenance here, remember to include enough to cover those.

Retirement: If you make separate contributions every month to a retirement fund out of your take-home pay, enter them here. However, if your retirement contributions come out of your paycheck before you take that check home, dont enter them again.

Investments: Use this line for any other kinds of savings you might need. If you make contributions to an individual investment account, for example, you can enter those here.

You can also use this line to contribute to any special fund youre investing in, like saving up for a wedding, for a car, or for a down payment on a new home.

Don’t Miss: Best Bean Pie Recipe

Huge Flexibility It Can Also Become A Family Of Household Budget Calculator

While this Excel template works perfectly as a personal budget, it can also quickly transform into a household or family budget for your home. Whatever you decide to do with it, this free, printable, monthly spreadsheet / worksheet will make your budget simple, easy to understand, and fun.

Give this personal budget template a try and see if it will work you. Most people find the added budget calculator features to be quite helpful as it gives them greater insights into how theyre using their money. The extra features also make it quite a bit more fun and interesting.