How Do I Calculate My Marginal Tax Rate

To calculate your marginal tax rate, you will need to look at the tax bracket table for the current year . First, calculate your adjusted gross income by subtracting the standard deduction or itemized deductions and any other allowable above-the-line deductions from your total income. Then multiply each portion of your AGI by the tax rate for each income level and add the totals for your total income tax obligation.

Central Services To The Public

- Elections Running local and national elections and maintaining the electoral register.

- Local tax collection Collecting Council Tax for our own services and on behalf of the county council, the fire authority, the police and crime commissioner and national business rates collection.

- Housing Benefit and Council Tax support Payment of Housing Benefit and Local Housing Allowance and Council Tax support to those on a low income, whether they are working or not. This includes pensioners.

The Gst And State Taxes

As with most federations around the world, State and Territory governments in Australia spend more than they raise in revenue. The difference is made up by grants from the Australian Government.

The States and Territories receive all revenue raised by the GST. About 23 per cent of total state revenue comes from the GST, with statelevied taxes generating about 31 per cent of total state revenue. The GST is relatively efficient compared to some other taxes because it has a much broader base than many other taxes. However, exemptions reduce its efficiency and introduce significant complexity. In total, around 47 per cent of Australias national consumption is subject to GST.

Legislation requires that changes to the GST base or rate require unanimous agreement by all State and Territory governments, as well as both houses of the Australian Parliament. The Australian Government will not support changes to the GST without a broad political consensus for change, including agreement by all State and Territory governments.

The major sources of state tax revenue are payroll taxes and stamp duties. State governments also impose taxes on land, gambling and motor vehicles. Municipal rates are the sole source of local government tax revenue.

Some studies suggest significant economic gains from state tax reform, particularly reduced stamp duties and greater use of payroll and land taxes.

Recommended Reading: Plastic Pie Containers With Lids

How The State Collects Money

Technical Terms

Gross Receipts Taxes Taxes collected on the gross receipts of a business or service provider. It is usually passed along to the consumer.Compensating Tax A tax on goods that are bought out-of-state for use in New Mexico. Say, for example, you open a restaurant in New Mexico but purchase your chairs and tables in Texas. You must pay compensating tax on those purchases.Excise Taxes Taxes levied on specific goods, such as cigarettes, alcohol, and cars.Income Taxes Taxes paid on an individuals personal income or a companys profits.Severance Taxes Taxes paid on natural resources such as crude oil and natural gas, so named because these resources are severed from the ground.

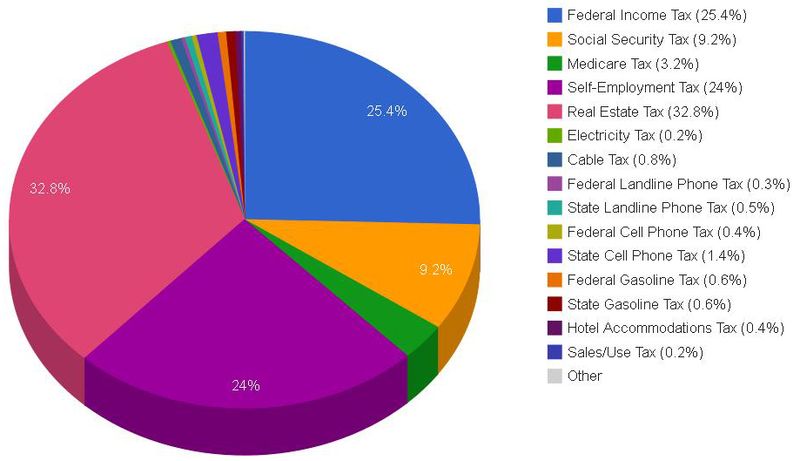

Americans Pay Many Types Of Taxes

The federal government collects revenues from a variety of sources such as:

- Individual income taxes the largest source of tax revenues and half of total receipts annually. Income taxes are levies on wages and salaries earned by individuals, income from investments, and other income.

- Payroll taxes, which help to finance Social Security, Medicare, and unemployment benefits, are the second-largest source of federal revenues and make up about one-third of total receipts annually. Payroll taxes are deducted from workers’ paychecks through a line item called FICA, which stands for the Federal Insurance Contributions Act.

- The government also collects taxes on the profits of corporations. Since January 1, 2018, most corporate income has been taxed at 21 percent at the federal level.

- Excise taxes are indirect levies upon transactions of particular goods or activities, such as gasoline, alcohol, or gambling.

- Customs duties are taxes imposed on specific imported goods.

- Other sources include estate and gift taxes and payments to the Federal Reserve.

Recommended Reading: Quick And Easy Chicken Pot Pie

The Effect Of Credits And Deductions

Tax credits and deductions must also be taken into consideration because they heavily influence how much of an individuals income will ultimately be taxed.

The taxpayer with the $300,000 income can bring that figure down to $287,600 just by claiming the standard deduction for their single filing status, which is $12,400 for tax year 2020. The $15,000-a-year persons taxable income would drop to just $2,600, assuming theyre also single and they claim the $12,400 standard deduction.

The six-figure taxpayer might potentially bring their taxable income down even more by itemizing instead. Taxpayers claimed $42.8 billion in itemized charitable donation deductions in 2017. The taxpayer who earns just $15,000 a year likely would not contribute much to that number. Generally, wealthier taxpayers are more likely to take advantage of this itemized deduction because it requires some amount of disposable income.

The same applies to the mortgage interest deduction, which resulted in $63.6 billion being shaved off taxpayers incomes in 2017. Low-income individuals generally dont pay enough interest on mortgages to give them a sizable tax deduction.

Property and state taxes accounted for $69.3 billion in claimed tax deductions in 2017, and it stands to reason that the majority of that total can be attributed to people who paid the most in such taxeshigh-income individuals.

How Much Do Taxes Contribute To Total Federal Revenue

Individual income taxes are the single biggest category of federal revenue, accounting for roughly 40 percent of all money the U.S. Treasury takes in. The other major category is tax for Social Security and Medicare, accounting for another 30 percent or so.

Corporate income taxes make up roughly 10 percent more, while excise taxes and other revenue sources account for the remainder.

This distribution is very different from what it has been historically. Back in the 1930s and before, excise taxes particularly on alcohol made up the largest category of federal receipts. But over time, the United States began to rely more on individual and corporate income taxes for revenue.

As a share of federal receipts, taxes on Social Security and Medicare have also ballooned in recent decades.

Recommended Reading: How Long Do You Bake Shepherd’s Pie

The Us Tax System Is Progressive

As a whole, the U.S. tax code remains progressive with higher-income taxpayers paying a greater share of their income in taxes. That is true despite the fact that high-income Americans benefit disproportionately from tax breaks, otherwise known as tax expenditures.

Major tax expenditures such as lower rates on capital gains and dividends, deductions for charitable contributions, and deductions for state and local taxes tend to benefit higher-income taxpayers more than lower-income groups. CBO estimates that the top quintile of taxpayers receive 51 percent of the value of major tax expenditures, while only 8 percent goes to the bottom quintile. However, even with substantial tax expenditures, the top one percent of American taxpayers still pay an effective tax rate of 29 percent, on average, while the bottom 20 percent of the population pay an average of 3 percent.

TPC estimates that 68 percent of taxes collected for 2019 came from those in the top quintile, or those earning an income above $163,600 annually. Within this group, the top one percent of income earners those earning more than $818,700 per year will contribute over one-quarter of all federal revenues collected.

While the fairness of the tax system is much debated, many economists agree that simplifying the tax code would help the economy. Further tax reform could promote economic growth while also making the code more simple, transparent, and fair.

Tax Day Chart: Who Pays The Most

Which taxpayers experience the greatest tax burdenand who pays the most in taxes?

As Americans navigated the labyrinthine tax code ahead of tax day, many felt the sting of the Presidents myriad tax increases.

Despite calls for more taxes on the rich, the Heritage chart shown above reveals that the recent tax increases disproportionately affect the working wealthy. The top 10 percent of all income earners paid 71 percent of federal income taxes in 2010, yet they earned 45 percent of all federal income. Compare that to the bottom 50 percent of earners, who earn 12 percent of income yet pay only 2 percent of federal income taxes.

So when Obama and advocates of higher federal taxes opine that the rich do not pay their fair share, they are correctaffluent income-earners pay a whole lot more than they would pay if we had a proportional tax code instead of the highly progressive one we have today.

While taxes have increased for most taxpayers, the wealthy arerelative to the rest of the populationincreasingly shouldering the federal tax burden. The Wall Street Journals John McKinnon notes that this burden has shifted largely as a result of the tax changes passed at the start of 2013 during the fiscal cliff debates. These changes include a bump in the top ordinary income rate to 39.6% from 35%, a limit on itemized deductions and an increase in the top rate on investment income.

The Daily Signal depends on the support of readers like you. Donate now

Most Uk Government Revenue Is From Tax

In 202122, total UK government revenue is forecast to be £819 billion, or 36% of gross domestic productGross domestic product is a measure of an economys size. It is the monetary value of all market production in a particular area in a given period .Read more is a measure of an economys size. It is the monetary value of all market production in a particular area in a given period .Read more). The primary source of revenue is taxation, which is forecast to raise £732 billion in 202122, or 32% of GDPGross domestic product is a measure of an economys size. It is the monetary value of all market production in a particular area in a given period .Read more equivalent to £13,400 for each adult living in the UK.

£88 billion of government revenue is not accounted for by taxation. Non-tax revenues include, among other things, income received by government from public corporations and interest payments on government assets .

Where Your Income Tax Money Really Goes // Wrl Pie Chart Flyer Fy2017

The current edition of the War Resisters League’s famous “pie chart” flyer, Where Your Income Tax Money Really Goes, analyzes the Federal Fiscal Year 2017 Budget. . Perfect for Tax Day leafletting, as a focus for forums and panels and workshops and more!

Each year, War Resisters League analyzes federal funds outlays as presented in detailed tables in “Analytical Perspectives” of the Budget of the United States Government. Our analysis is based on federal funds, which do not include trust funds — such as Social Security — that are raised separately from income taxes for specific purposes. What you pay by April 18, 2016 goes to the federal funds portion of the budget.

How Were the FY2017 Pie Chart Figures Determined?

Government DeceptionThe pie chart is the government view of the budget. This is a distortion of how our income tax dollars are spent because it includes Trust Funds , and most of the past military spending is not distinguished from nonmilitary spending. For a more accurate representation of how your Federal income tax dollar is really spent, see the large graph.

Pentagon Spending vs. Security

The biggest contribution the United States can make to combating terrorism worldwide is to abandon the war paradigm and extricate itself from the wars that have served as such an effective recruiting device for new terrorists.

Matthew Evangelista

TAKE ACTION: What You Can Do

FY2017 Pie Chart Flyer

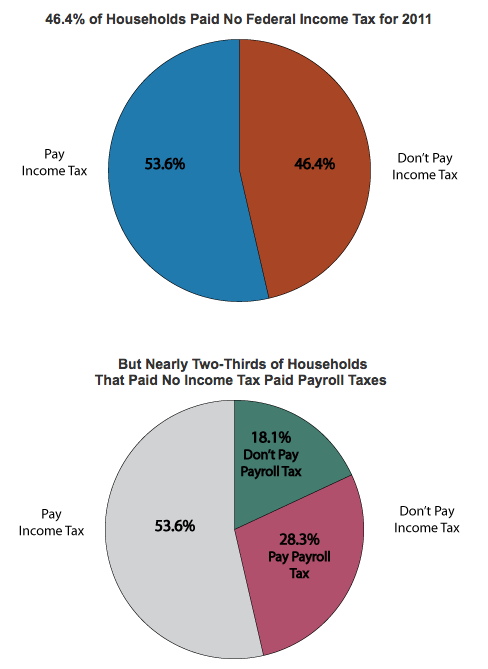

Okay Folks Let’s Put Aside Politics And Talk About Taxes

And understandably so.

Everyone hates taxes.

And everyone wants someone else to pay all the taxes.

Also, we have a massive budget deficit right now, and most reasonable people agree that the only way to balance the budget will be to cut spending growth and pay more taxes.

And no one likes the sound of more taxes.

But who pays those taxes, anyway?

How much is too much?

What’s fair?

Who should pay more?

We can’t really have an intelligent discussion of taxes without knowing who pays them.

And, politically, it’s “silly season” right now, with each side saying whatever it thinks it has to to win, so we can’t rely on politicians to tell us about taxes.

So, let’s put aside politics for a few minutes and look at some facts…

The Tax Burden For Low

Only 1.4% of the $1.45 trillion in taxes paid in 2017 was contributed by taxpayers earning less than $30,000, according to the Pew Research Center.

It should also be noted that many taxpayers in this income group received income from the government in the form of those refundable tax creditsthe IRS paid out about $62 million in earned income tax credits in 2020. The average payment to qualifying taxpayers was $2,461.

Why Is The Federal Income Tax A Progressive Tax

A progressive tax system is designed to distribute the tax burden more heavily toward those who have more income. Its supporters reason that taxpayers with higher wages have greater means to support government services, and it’s meant to support a thriving middle class. Detractors argue that this discourages people from earning more since they will have to pay a higher tax rate if they do.

The Tax Burden For High

Wealthy individuals do indeed pay more in taxes than low-income or even middle-income individuals. It’s just basic math.

Even if the tax system were not progressive and everyone paid the same percentage of their incomes, 15% of $30,000 is a great deal less than 15% of $300,000. But we do have a progressive system, so high-income individuals pay higher effective tax rates, even after all those tax credits and deductions are taken into consideration. Those deductions wont reduce $300,000 to $30,000.

The Pew Research Center indicates that taxpayers with AGIs in excess of $200,000 paid more than half of all taxes collected in 201558.9%, to be exact.

Those with incomes over $2 million paid a 27.5% effective tax rate, triple that of taxpayers who earned less than six figures annually, although the effective rate drops to 25.9% for the super-wealthy who earned $10 million a year or more.

The Tax Foundations study concluded that 96.9% of all 2017 income taxes were paid by the higher-earning 50% of taxpayers.

The Pew Research Center study indicates that taxpayers earning between $200,000 and $500,000 annually paid an effective tax rate of 19.4% in 2015. Their income taxes represented 20.6% of the total taken in by the IRS. This decreased to 17.9% of the total taxes paid at an effective tax rate of 26.8%for those with incomes between $500,000 and $2 million.